We produce oil and gas in the Gulf of Mexico, heavy oil in California and primarily tight gas and oil from liquids-rich shales in Pennsylvania and Texas, respectively. The majority of our oil and gas production interests are acquired under leases granted by the owner of the minerals underlying the relevant acreage, including many leases for federal onshore and offshore tracts. Such leases usually run on an initial fixed term that is automatically extended by the establishment of production for as long as production continues, subject to compliance with the terms of the lease (including, in the case of federal leases, extensive regulations imposed by federal law).

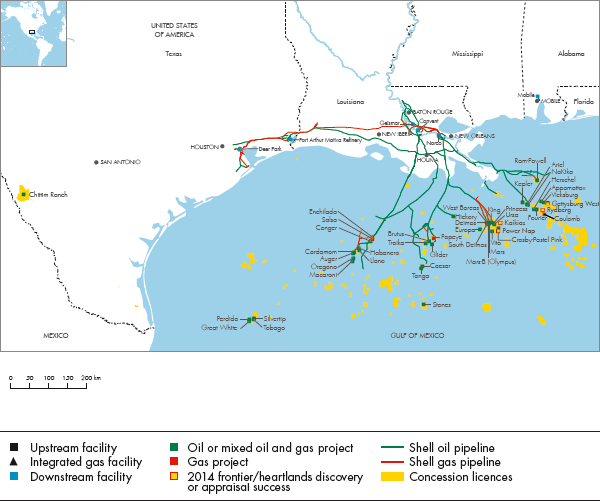

Gulf of Mexico

The Gulf of Mexico is our major production area in the USA, and accounts for over 50% of Shell’s oil and gas production in the country. We have an interest in approximately 450 federal offshore leases and our share of production averaged almost 225 thousand boe/d in 2014. Key producing assets are Auger, Brutus, Enchilada, Mars, Na Kika, Olympus, Perdido, Ram-Powell and Ursa.

We continued significant exploration and development activities in the Gulf of Mexico in 2014, with an average contracted offshore rig fleet of nine mobile rigs and five platform rigs. We also secured five blocks in the central and western lease sales in 2014.

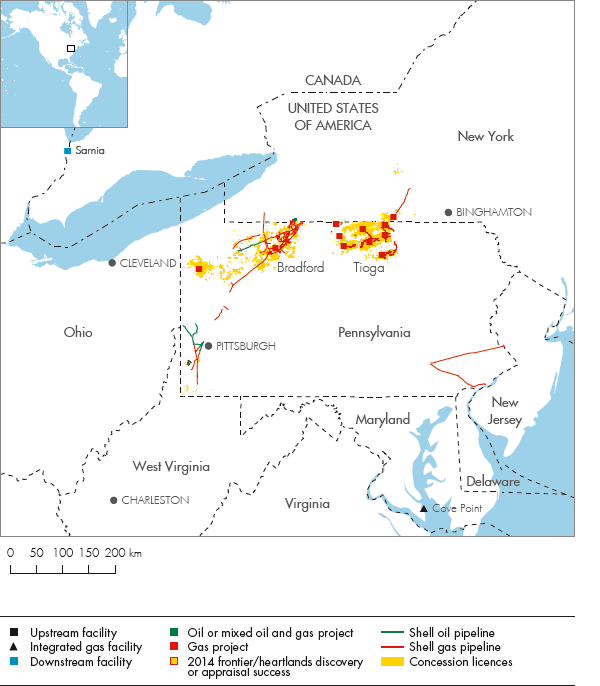

Onshore

We have significant tight-gas and liquids-rich shale acreage including in the Marcellus and Utica shales, centred on Pennsylvania in northeast USA and the Delaware Permian Basin in west Texas.

During 2014, we divested our interests in the Eagle Ford shale formation in Texas, the Mississippi Lime in Kansas, the Utica shale position in Ohio and our acreage in the Sandwash Niobrara basins in Colorado. In addition, we sold our Haynesville gas assets in Louisiana for cash and sold our Pinedale gas assets in Wyoming in exchange for cash and additional acreage in the Marcellus and Utica shale areas in Pennsylvania.

In recent years, we have invested significant amounts in our tight-gas and liquids-rich shale portfolio. There is still a large amount of drilling that must be conducted in our properties in order to establish our future plans. Following the asset sales in 2014, the current focus is on derisking and future development of our core assets, while continuing to look for options to enhance the value of our portfolio in the current market.

California

We have a 51.8% interest in Aera Energy LLC (Aera), which has assets in the San Joaquin Valley and Los Angeles Basin areas of southern California. Aera operates more than 15,000 wells, producing approximately 130 thousand boe/d of heavy oil and gas.

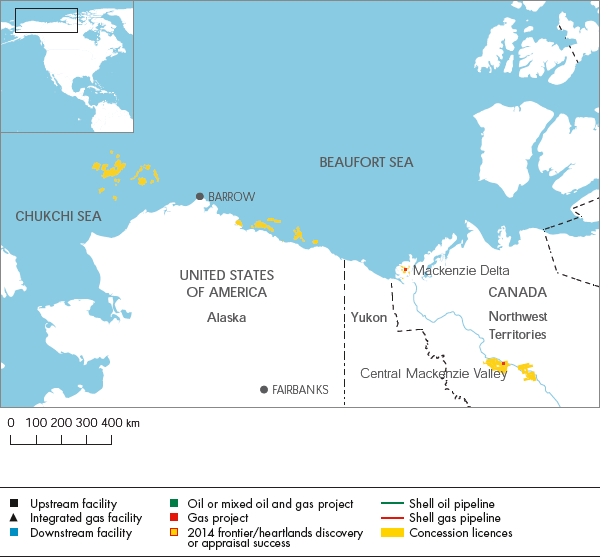

Alaska

We have more than 410 federal leases for exploration in the Beaufort and Chukchi seas in Alaska. In January 2014, we decided to suspend our 2014 drilling campaign due to obstacles raised by the Ninth Circuit Court of Appeal’s decision with regard to the Department of the Interior’s (DOI) 2008 oil and gas lease sale in the Chukchi Sea. In August 2014, we submitted an Exploration Plan for a two-rig programme in the Chukchi Sea. In March 2015, the DOI released a Record of Decision reaffirming Lease Sale 193 and clearing the way for the Bureau of Ocean and Energy Management (BOEM) to conclude its review of the Revised Chukchi Sea Exploration Plan. Shell has begun to mobilise vessels in readiness for exploration.