Project delivery

Projects under construction |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Start up |

Project |

Country |

Shell share (direct & indirect) |

Peak Production 100% kboe/d |

LNG 100% capacity mtpa |

Products |

Legend |

Theme |

Shell Operated |

||

|

|||||||||||

2016-17 |

Forcados Yokri Integrated Project (FYIP) |

Nigeria |

30 |

50 |

|

|

|

Conventional oil + gas |

|

||

|

Gbaran-Ubie Ph2 |

Nigeria |

30 |

150 |

|

|

|

Conventional oil + gas |

|

||

|

Geismar AO4 |

United States |

100 |

|

|

425 kta alpha olephins |

|

Chemicals |

|

||

|

Kashagan ph1 |

Kazakhstan |

17 |

300 |

|

|

|

Conventional oil + gas |

|

||

|

Lapa |

Brazil |

30 |

79 |

|

|

|

Deep water |

|

||

|

Lula Central |

Brazil |

25 |

131 |

|

|

|

Deep water |

|

||

|

Lula Extreme South |

Brazil |

25 |

142 |

|

|

|

Deep water |

|

||

|

Lula South |

Brazil |

25 |

145 |

|

|

|

Deep water |

|

||

|

Malikai |

Malaysia |

35 |

60 |

|

|

|

Deep water |

|

||

|

ML South |

Brunei |

35 |

35 |

|

|

|

Conventional oil + gas |

|

||

|

NA LRS/tight gas |

USA/Canada |

various |

82 |

|

|

|

Shales |

|

||

|

Pernis solvent deasphalting |

Netherlands |

100 |

|

|

7.2 kbpd |

|

Oil Products |

|

||

|

Schiehallion Redevelopment |

United Kingdom |

55 |

125 |

|

|

|

Conventional oil + gas |

|

||

|

Scotford HCU debottleneck |

Canada |

100 |

|

|

14 kbpd |

|

Oil Products |

|

||

|

Stones |

United States |

100 |

50 |

|

|

|

Deep water |

|

||

2018+ |

Appomattox |

United States |

79 |

175 |

|

|

|

Deep water |

|

||

|

Atapu North [A] |

Brazil |

25 |

148 |

|

|

|

Deep water |

|

||

|

Atapu South [A] |

Brazil |

25 |

147 |

|

|

|

Deep water |

|

||

|

Baronia/Tukau Timur |

Malaysia |

40 |

65 |

|

|

|

Conventional oil + gas |

|

||

|

Berbigão/Sururu [A] |

Brazil |

25 |

134 |

|

|

|

Deep water |

|

||

|

Clair Ph2 |

United Kingdom |

28 |

100 |

|

|

|

Conventional oil + gas |

|

||

|

Coulomb |

United States |

100 |

20 |

|

|

|

Deep water |

|

||

|

Lula North |

Brazil |

25 |

147 |

|

|

|

Deep water |

|

||

|

Nanhai China Chemicals |

China |

50 |

|

|

1200 kta C2 |

|

Chemicals |

|

||

|

Pennsylvania cracker |

United States |

100 |

|

|

1500 kta C2 |

|

Chemicals |

|

||

|

Prelude FLNG |

Australia |

68 |

110 |

3.6 |

|

Integrated gas |

|

|||

|

Rabab Harweel Integrated Project |

Oman |

34 |

40 |

|

|

|

Conventional oil + gas |

|

||

|

Southern Swamp AG |

Nigeria |

30 |

30 |

|

|

|

Conventional oil + gas |

|

||

|

Tempa Rossa |

Italy |

25 |

45 |

|

|

|

Conventional oil + gas |

|

||

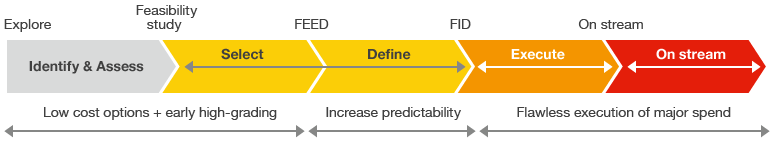

Enhancing capital efficiency

Appomattox

(Shell interest 79%,

Shell operated)

In 2015, Shell announced the FID to advance the Appomattox deep-water development in the Gulf of Mexico. This decision authorises construction and installation of what will be our eighth and largest floating platform in the Gulf of Mexico.

The Appomattox development will initially produce from the Appomattox and Vicksburg fields, with average peak production estimated to reach approximately 175,000 barrels of oil equivalent per day (boe/d).

Currently, we are the only operator in the Gulf of Mexico with commercial deep-water discoveries in this formation, called Norphlet, which dates back 150-200 million years to the Jurassic period.

Stones

(Shell interest 100%,

Shell operated)

Stones is an ultra deep-water oil and gas development in the Gulf of Mexico. It will host the deepest production facility in the world in some 2,900 metres (9,500 feet) of water. The project is located in the Gulf of Mexico’s lower tertiary geologic trend. This is a new frontier in oil and gas deep water, where Shell achieved first commercial production with Perdido.

It will reach 50 kboe/d peak production for the first phase of development, from more than 250 million boe of recoverable resources. The Stones field has significant upside potential and is estimated to contain more than 2 billion boe of oil in place.

Prelude

(Shell interest 67.5%,

Shell operated)

The construction of the Prelude floating LNG project is well underway and cash flow contribution from the development is expected in 2018. The drilling campaign was concluded at the end of 2015 with the successful completion of all seven production wells. In Geoje, South Korea all 14 topsides and the flare tower are now installed on the Prelude facility. Once completed, the facility will be towed to the Browse basin off the north coast of Western Australia, where it will extract, process, store and transfer 5.3 million tonnes per annum of LNG, LPG and condensate at sea. A major subsea campaign was completed in February 2016 which saw the installation of the four huge anchor piles that will anchor the flowlines and other sea-bed production equipment on the seabed.

Pennsylvania chemicals

(Shell interest 100%,

Shell operated)

On June 7, 2016 we announced the FID on a new, 1.5 million tonnes per annum (mtpa) cracker and polyethylene plant in Pennsylvania, USA, which will use natural gas from shales production as its feedstock to produce polyethylene.

Polyethylene is used in many products, from food packaging and containers to automotive components. Commercial production is expected to begin early in the next decade.

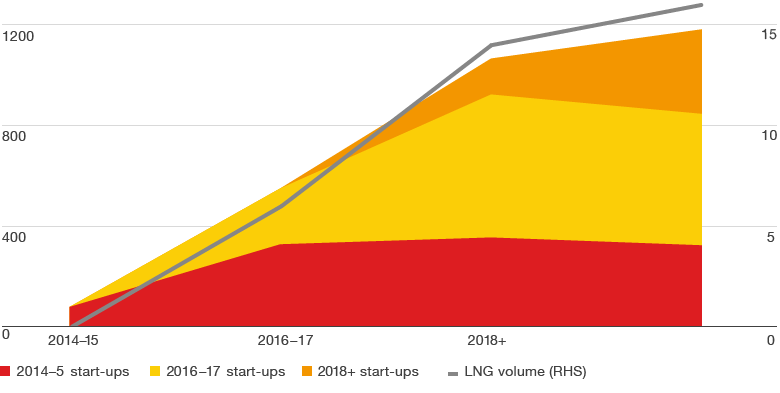

Projects under construction

Thousand boe per day [A]

mtpa [B]

[A] BG organic growth from 1.1.2016.

[B] LNG volume includes offtake.