Shell and BG

The BG combination was designed to accelerate Shell’s growth strategy in deep water and LNG, enhance our free cash flow, and create a platform from which we can reshape Shell. It is about transforming Shell into a world-class investment case to create value for shareholders.

Strategic fit

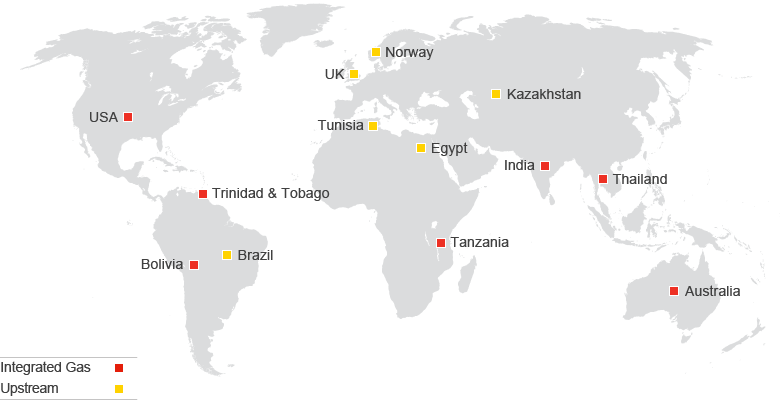

The complementary portfolios of Shell and BG made for a great strategic fit. By combining BG’s portfolio and skill set with Shell’s capabilities, we greatly enhanced our Integrated Gas and deep-water portfolio, as well as our Trading and Supply business.

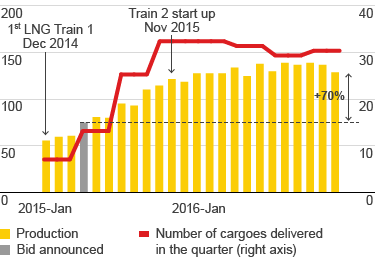

In Integrated Gas, the combined group unified two world-class portfolios and will deliver attractive LNG opportunities, such as the QCLNG project in Australia and the expansion of Shell’s position in Trinidad and Tobago. In Upstream, BG’s deep-water acreage in Brazil offers near-term growth in the Santos Basin, complementing Shell’s Libra field acreage. Shell’s Downstream Trading and Supply business has performed strongly in recent years and the combination presents new opportunities, in particular to further build capabilities in LNG, gas and crude oil trading, and in shipping.

In this way, the combination of the two companies builds upon the strategic focus and direction that Shell has pursued for many years.

World-class integration

Delivering the real value from the BG deal has been all about a swift and effective integration – getting value from BG projects and learning from BG's best working practices to ensure that Shell can become a more resilient, agile and profitable company. Shell formally completed the integration by the end of 2016.

The strong performance of BG assets during the 10 months leading up to the acquisition, as well as throughout 2016, underscores Shell’s belief that the timing was right for this acquisition.

Capturing value

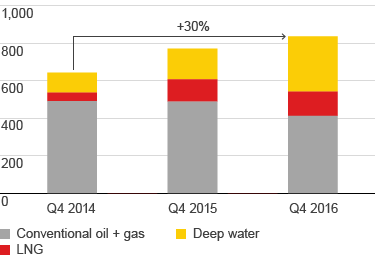

The acquisition of BG was transformational for Shell. As a result, Shell became one of the largest international oil companies by market capitalization, cash flow, and production, the top LNG trader, and a major deep-water oil producer.

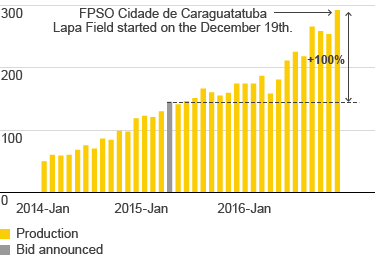

Key growth assets acquired from BG contributed significantly to Shell’s production growth in 2016, driving a 70% increase in Australia and a 100% increase in Brazil.

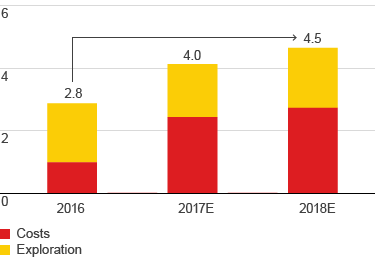

BG has proven to be a major catalyst for cost reductions through savings and synergies. We initially identified around $2.5 billion of externally verified pre-tax synergies per year in 2018. We have continued to look at all potential synergies from the combination with BG, and as a result, now expect the synergies from the deal to be $4.5 billion on a pre-tax basis in 2018 – 80% more than what was initially expected.

Increasing production

kboe/d

BG synergies identified

$ billion

Queensland LNG

kboe/d

number

Brazil pre-salt

kboe/d