Financial framework

Shell’s strategy and financial framework are designed to manage through multi-year macroeconomic cycles and multi-decade investment and returns programmes. We balance near-term affordability and cost trends with the fundamentally long-term nature of our industry.

The balance sheet must support dividends and re-investment through the low points in oil market cycles. Our intention is to generate sufficient free cash flow at the lower end of the price cycle to cover the cash dividend.

Cash flow priorities 2016–18

reduction

Our priorities for cash flow are reducing debt and paying dividends, followed by a balance of share buybacks and capital investment.

Shell’s dividend distributed in 2016 was $15 billion. Our dividend policy is to grow the US dollar dividend through time, in line with our view of Shell’s underlying earnings and cash flow. When setting the dividend, the Board looks at a range of factors, including the macroeconomic environment, the current balance sheet and future investment plans.

We see potential for at least $25 billion of buybacks in the period 2017-2020, subject to debt reduction and recovery in oil prices.

Four levers

We have identified four levers to manage through the market down-cycle: divestments, reduced capital investment and operating expenses, and delivering new projects that will add significant cash flow.

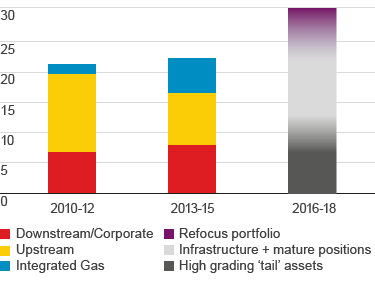

Divestment programme

$ billion

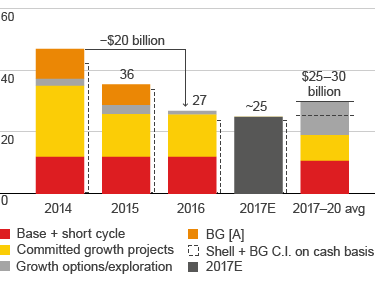

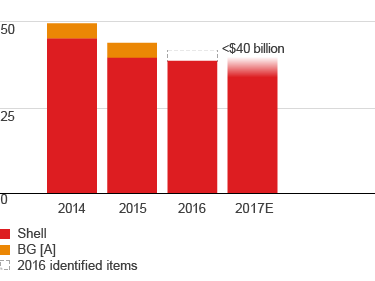

Capital investment

$ billion; excludes BG acquisition in 2016

[A] Historical BG capital investment based on BG's published Annual Reports.

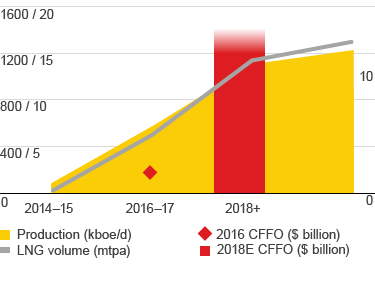

Underlying operating expenses

$ billion

[A] Historical BG operating expenses based on BG's published Annual Reports.