In Focus: LNG Outlook

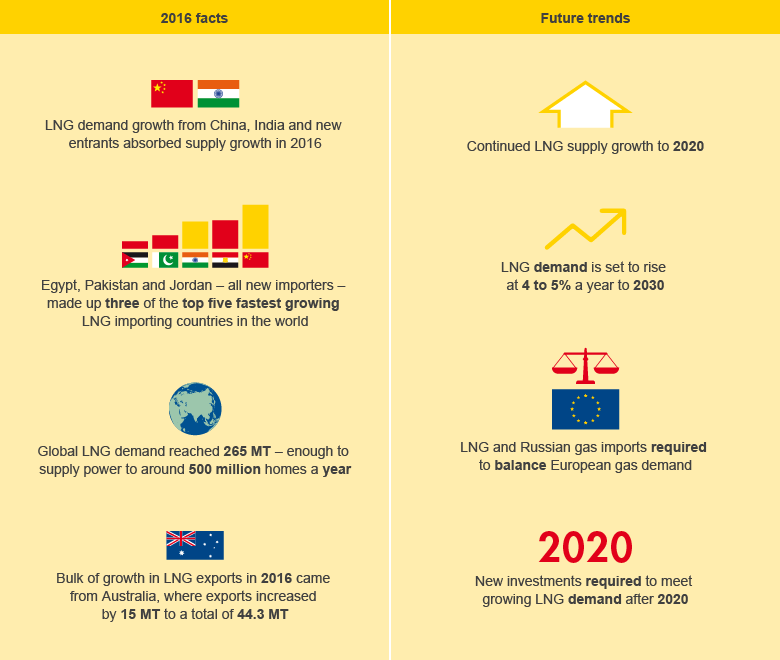

Shell launched its first LNG Outlook in February 2017. Drawing on a broad range of independent industry data and internal analysis, the Outlook highlights key trends in 2016 and focuses on future global demand and supply ().

LNG demand reached 265 million tonnes in 2016, with growth expected to continue at 4-5% a year up to 2030. The LNG Outlook highlights the critical role of gas in the transition to a low-carbon future.

Many analysts expected a strong increase in new LNG supplies to outpace demand growth during 2016. However, demand growth kept pace with supply as greater than expected demand in Asia and the Middle East absorbed an increase in supply from Australia.

LNG trade is changing to mirror the shifting needs of buyers, including shorter-term, lower-volume contracts with greater flexibility.

Building on the BG tradition of producing a similar publication, we intend to offer a balanced and informative outlook for LNG. This business is not only a significant part of our portfolio, but is also a vital part of the energy industry future.

LNG market views