Conventional exploration

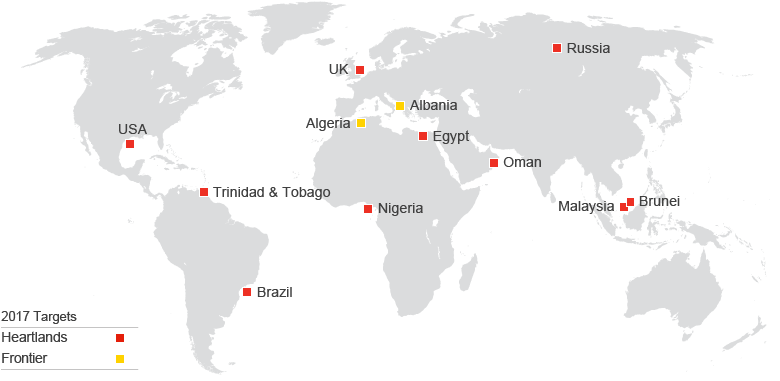

In conventional exploration, we are executing a strategy focused on both short-term value through established ventures and mid-term growth through expanding our heartlands and selectively exploring in new frontier basins.

Following the acquisition of BG and our exit from offshore Alaska, exploration expenditure has been reduced to $2.5 billion per year. Our investments are balanced between:

- exploration near our existing assets, which can be brought on stream quickly and generate high value;

- testing new geological concepts and finding new oil and gas resources within our existing heartlands; and

- building new frontier positions in under-explored areas with the potential for significant discoveries, but which will take longer to develop.

In 2016, we had four notable discoveries (in Egypt, Malaysia and the USA) and two appraisal successes (in Brunei and Malaysia). We made 13 near-field discoveries close to our existing Upstream assets, with many of these new discoveries already in production by the end of 2016.

Over the past six years, 6 billion barrels of contingent resources were added, including 1.5 billion barrels from deals (this does not include the legacy BG contingent resources). The finding costs derived from discoveries in this six-year period is around $4 per barrel on average, with a 45% success rate.

We added new conventional exploration acreage in, amongst others, Brazil, Bulgaria, Bolivia, Kenya, Myanmar, Tanzania and Trinidad and Tobago. This included acreage from the BG combination.

Shell will continue to deliver high-value exploration through high-grading the integrated Shell and BG portfolio, leveraging the best of both.

Conventional exploration themes

Frontier

Build-up of acreage, de-risking and drilling in under-explored basins

Prospect size

(million boe)

>250

Time to production

(years)

10+

Heartlands

High-value near field exploration and drilling new geological plays in Shell producing basins

Prospect size

(million boe)

1-250

Time to production

(years)

1-5+

Prospect size (million boe)

Time to production (years)