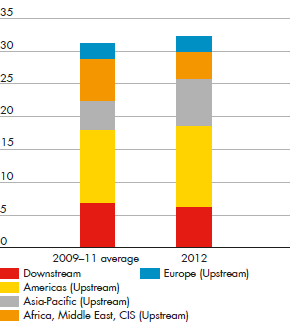

We are planning a net capital investment of some $30 billion in 2012 – an increase from 2011 levels – as Shell invests for long-term growth. This amount relates largely to investments in some 17 new projects for which final investment decisions were taken in 2010–2011. They are part of a portfolio of more than 60 new growth projects that are under construction or being assessed for future investment. Going forward, annual spending will be driven by the timing of investment decisions and the near-term macroeconomic outlook.

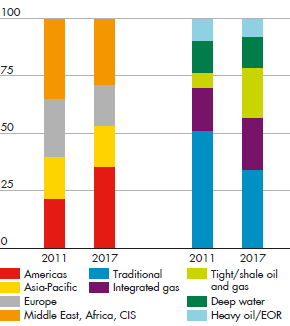

In early 2012, Shell defined a set of ambitious financial and operating targets for profitable growth. These targets are driven by Shell’s performance in maturing new projects for final investment decision and by project start-ups.

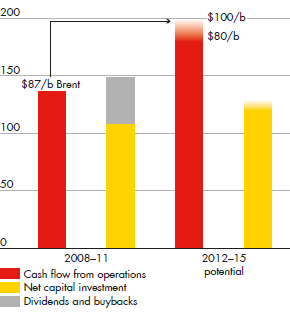

Cash flow from operations (CFFO), excluding working capital movements, was $136 billion for 2008–2011. We expect aggregate cash flow from operations, excluding working capital movements, for 2012–2015 to be 30-50% higher, assuming that the Brent oil price is in the range of $80-100 per barrel and that conditions improve for North American natural gas prices and downstream margins relative to 2011.

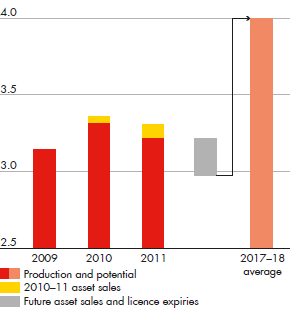

In Upstream we have the potential to reach an average production of some 4.0 million boe/d in 2017–2018, compared with 3.2 million boe/d in 2011. This production potential will be driven by the timing of investment decisions and the near-term macroeconomic outlook, and assumes some 250 thousand boe/d of expected asset sales and licence expiries. In Downstream we are adding new refining capacity in the USA and making selective growth investments in marketing.