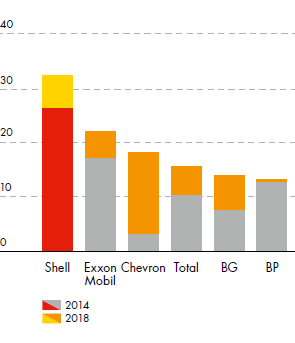

LNG leadership [A][B]year-end mtpa

- [A]

- LNG equity capacity of projects in operation or

under construction.

- [B]

- Data source for competitor data: IHS.

Shell is an LNG industry pioneer with expertise gained over 50 years. Shell was instrumental in delivery of the world’s first LNG plant in Algeria, which came on stream in 1964. In the years since, LNG has become a global commodity with demand expected to grow rapidly in the coming years. Currently around 240 mtpa, the global LNG market is expected to reach about 430 mtpa by 2025. This growth will be driven by economic growth and new destinations in China, India, South-east Asia and the Middle East as well as by demand in Europe.

Shell is proud of its leadership in this sector. Our global LNG equity liquefaction capacity is about 26 mtpa. Our equity share of various ventures across the world delivered about 10% of LNG sold worldwide in 2014.

Our LNG portfolio is also well-positioned for growth. We have 7.5 mtpa of additional equity liquefaction capacity under construction and we have an interesting option set.

Progress on the Prelude FLNG facility continues. FLNG is a great example of Shell achievements in developing new oil and gas technologies. Allowing the production, processing and liquefaction of gas out at sea is an innovation that will help access energy resources in remote areas. This can mean faster, more cost-effective and flexible development of resources that were previously uneconomic or too technically challenging. The Woodside-operated Browse project has selected Shell FLNG technology for its development concept.

Shell is well placed to add value through gas market opportunities by supplying contracted customers from multiple Shell LNG sources rather than a single point. In addition to our entitlement of LNG from plants in which we own an equity stake, Shell sources LNG via purchase agreements from a variety of sources. Shell has the largest LNG portfolio among the international oil companies of more than 30 mtpa delivered in 2014, which includes both Shell directly managed and joint venture marketed volumes. This portfolio is expected to grow substantially, once Gorgon, Prelude and other projects are on stream.

Managing such a large and diverse LNG portfolio requires excellence in marketing and trading. Shell trades natural gas and electricity in many different parts of the world. Our 50 years of experience in the gas industry makes us one of the world’s most experienced marketers. We are also one of the largest LNG ship operators.

In order to secure access to customers, Shell owns capacity positions in several regasification terminals and continues to evaluate opportunities to grow this portfolio. As part of our Downstream business activities, we are also working to develop LNG as a transport fuel, which has the potential to provide economic benefits to operators of ships and heavy-duty trucks.