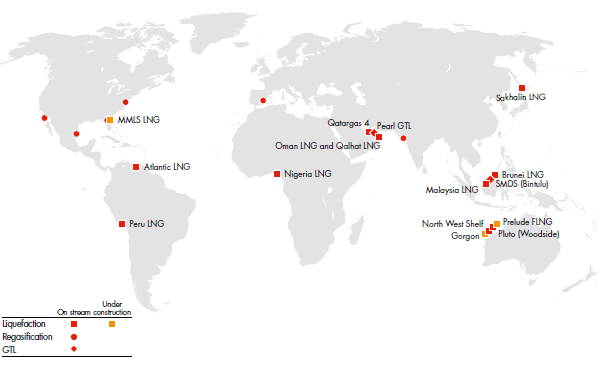

Strong gas market growth is a major opportunity for Shell. Our integrated gas earnings have more than tripled since 2010 to more than $10 billion in 2014 or about 45% of total group earnings. This was mainly driven by several large liquefied natural gas (LNG) and gas-to-liquids (GTL) projects that came on stream, including Pearl GTL, Pluto LNG Train 1 (Woodside), the North Rankin Redevelopment and Qatargas 4. An additional driver in 2014 was the completion of the Repsol LNG portfolio acquisition which delivered more than $1 billion of operating cash flow in 2014.

Integrated gas earnings include LNG marketing and trading, and GTL operations. In addition, the associated upstream oil and gas production activities from the Sakhalin-2, North West Shelf, Pluto LNG Train 1 (Woodside), Qatargas 4 and Pearl GTL projects are included in integrated gas earnings. Power generation and coal gasification activities are also part of integrated gas.

The Prelude floating LNG (FLNG), Gorgon LNG Trains 1 to 3 and the MMLS LNG projects are under construction and expected to come on stream within the next few years.

In Australia, Shell divested its 8% stake in the Wheatstone-lago joint venture and its 6.4% interest in the Wheatstone LNG project in 2014. Shell also reduced its stake in Woodside to around 14%.