IRAN

Shell ceased its upstream activities in Iran in 2010 as a direct consequence of the international sanctions imposed on Iran, including the US Comprehensive Iran Sanctions, Accountability and Divestment Act of 2010.

IRAQ

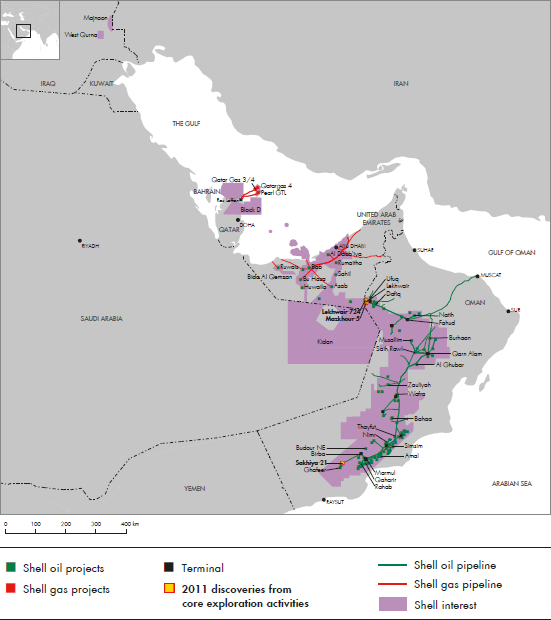

We hold a 20-year technical service contract, which expires in 2030, for the development of the Majnoon oil field and operate the field with a 45% interest. The other Majnoon shareholders are Petronas (30%) and the Iraqi state partner (25%), represented by the Missan Oil Company. Located in southern Iraq, Majnoon is one of the world’s largest oil fields. The Iraqi government estimates it to have about 38 billion barrels of oil in place. The first phase of the development is planned to bring production to some 175 thousand b/d from the start level of 45 thousand b/d, when the contract entered into effect in March 2010. We also hold a 15% interest in the West Qurna 1 field, as part of the ExxonMobil-led consortium. At the end of 2011, production was some 370 thousand b/d. According to both contracts’ provisions, Shell’s equity entitlement volumes will be lower than the Shell interest implies.

In November 2011, Shell signed an agreement with the government of Iraq to establish a joint venture between Shell (44%), the South Gas Company (51%) and Mitsubishi Corporation (5%). The joint venture will be called Basrah Gas Company (BGC). BGC will gather, treat and process raw gas produced from the Rumaila, Zubair and West Qurna 1 fields. Currently, an estimated 700 million scf/d of gas is flared because of a lack of infrastructure to collect and process it. The processed natural gas and associated products, such as condensate and LPG, will be sold primarily to the domestic market with the potential to export any surplus.

OMAN

We have a 34% interest in Petroleum Development Oman (PDO). PDO is the operator of an oil concession expiring in 2044. It currently produces about 550 thousand b/d.

We also participate in the development of the Mukhaizna oil field (Shell interest 17%) where steam flooding, an enhanced oil recovery method, is being applied on a large scale.

We have a 30% interest in Oman LNG, which mainly supplies Asian markets under long-term contracts. We also have an 11% indirect interest in Qalhat LNG, another Oman-based LNG supplier.

QATAR

Operators in the central control room,

Pearl GTL, Qatar.

Pearl GTL in Qatar is the world’s largest gas-to-liquids project. Shell provides 100% of the funding under a development and production-sharing contract with the government of Qatar. The fully integrated project includes production, transport and processing of some 1.6 billion scf/d of well-head gas from Qatar’s North Field with installed capacity around 140 thousand boe/d of high-quality liquid hydrocarbon products and 120 thousand boe/d of natural gas liquids and ethane. By the end of 2011, Train 1 was ramping up production and Train 2 had started up.

Shell has a 30% interest in Qatargas 4, which comprises integrated facilities to produce some 1.4 billion scf/d of natural gas from Qatar’s North Field, an onshore gas-processing facility and an LNG train with a collective production capacity of 7.8 mtpa of LNG and 70 thousand boe/d of natural gas liquids. The train delivered first LNG in January 2011 and has ramped up to full production during the year with the LNG shipped mainly to markets in the Middle East, Europe, Asia and North America.

Shell also holds a 75% equity interest in Block D under the terms of an exploration and production-sharing contract with Qatar Petroleum, representing the national government. Shell is the operator, with PetroChina holding a 25% interest.

UNITED ARAB EMIRATES

In Abu Dhabi we hold a concessionary interest of 9.5% in the oil and gas operations run by Abu Dhabi Company for Onshore Oil Operations (ADCO). The licence expires in 2014. We also have a 15% interest in the licence of Abu Dhabi Gas Industries Limited (GASCO), which expires in 2028. GASCO exports propane, butane and heavier liquid hydrocarbons that it extracts from the wet natural gas associated with the oil produced by ADCO.