HIGHLIGHTS

- Inaugurated the expansion of our joint-venture refinery in Port Arthur, Texas, more than doubling crude oil distillation capacity there to 620 thousand b/d. It is flexible, able to process many types of crude oil and vary the mix of final products based on demand.

- In Australia, the Clyde refinery was converted to a terminal.

- Optimised ethylene delivery in Supply and distribution, resulting in a 20% increase in throughput capacity and improved operating flexibility.

- Continued to demonstrate innovation in fuels technology and superior customer experience in Retail with the first launch of Shell V-Power Nitro+, which is now available in six countries. In China we also had the first launch of Shell V-Power in Tianjin province and signed an agreement with China Union Pay to enable faster and more convenient payment options.

- Making good progress with the Raízen biofuels joint venture in Brazil, which has a 35 thousand b/d ethanol production capacity. In its first full year of operations, Raízen contributed more than 10% to our 2012 Oil products earnings.

- Bought the remaining shares in Gasnor, a Norwegian supplier of LNG for shipping and trucking. It gives us a foothold in a growing market for cleaner-burning gas as a transport fuel.

- Entered into an agreement with joint venture partners to purchase assets at the Coryton refinery in Essex and worked with our partners to develop a state-of-the-art import and distribution terminal. This investment will support growth in our UK retail business, which acquired 253 retail sites in 2011.

- Agreed to acquire Neste Oil Corporation’s network of 105 retail sites in Poland. These sites are unmanned and located in major cities throughout the country.

- Progressed the proposed world-scale petrochemicals project in Ras Laffan Industrial City in Qatar by awarding, with venture partner Qatar Petroleum, the front-end engineering and design contract.

- Agreed with our partner SABIC to expand Sadaf, our long-standing Chemicals joint venture in Saudi Arabia – including proposed construction of new derivative units.

| Download XLS |

|

KEY STATISTICS | |||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

2012 |

2011 |

2010 |

2009 |

2008 | ||||

| |||||||||

|

Downstream CCS earnings ($ million) |

|

|

|

|

| ||||

|

Oil products |

3,959 |

2,235 |

1,439 |

(58) |

5,153 | ||||

|

Chemicals |

1,391 |

2,054 |

1,511 |

316 |

156 | ||||

|

Total Downstream earnings ($ million) [A] |

5,350 |

4,289 |

2,950 |

258 |

5,309 | ||||

|

Total Downstream earnings excluding identified items |

5,311 |

4,274 |

3,873 |

1,940 |

5,744 | ||||

|

Downstream cash flow from operations ($ million) [B] |

8,028 |

8,746 |

8,138 |

5,839 |

1,750 | ||||

|

Oil products sales volumes (thousand b/d) |

6,235 |

6,196 |

6,460 |

6,156 |

6,568 | ||||

|

Chemicals sales volumes (thousand tonnes) |

18,669 |

18,831 |

20,653 |

18,311 |

20,327 | ||||

|

Refinery processing intake (thousand b/d) |

2,819 |

2,845 |

3,197 |

3,067 |

3,388 | ||||

|

Refinery availability (%) |

93 |

92 |

92 |

93 |

91 | ||||

|

Chemical plant availability (%) |

91 |

89 |

94 |

92 |

94 | ||||

|

Downstream net capital investment ($ million) |

4,275 |

4,342 |

2,358 |

6,232 |

3,104 | ||||

|

Downstream capital employed ($ million) |

71,889 |

71,976 |

67,287 |

62,632 |

54,050 | ||||

|

Downstream employees (thousands) |

48 |

51 |

59 |

62 |

64 | ||||

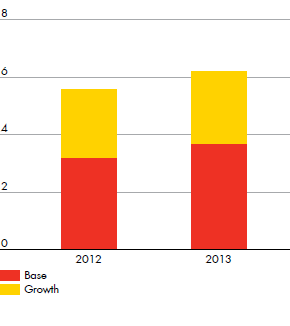

DOWNSTREAM CCS EARNINGS [A]$ billion

- [A]

- Excluding identified items.

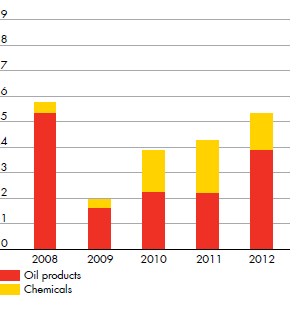

DOWNSTREAM ORGANIC CAPITAL INVESTMENT$ billion