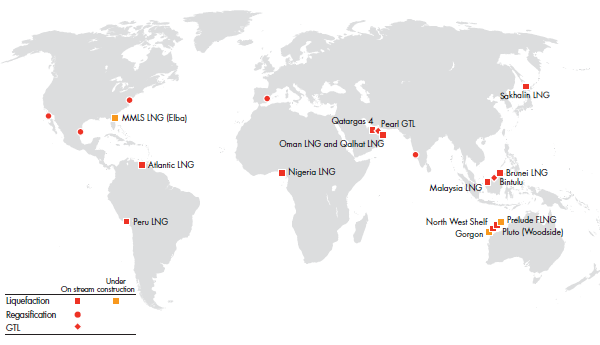

Strong growth in gas markets is a major opportunity for Shell. Our integrated gas earnings have increased by around 400% since 2009 to some $9 billion in 2013 or about 60% of Upstream earnings. This was mainly driven by several large liquefied natural gas (LNG) and gas-to-liquids (GTL) projects that came on-stream, including Pearl GTL, Pluto LNG Train 1 (Woodside), North Rankin Redevelopment, Qatargas 4 and Sakhalin-2. Integrated gas earnings incorporate LNG, including LNG marketing and trading, and GTL operations. In addition, the associated upstream oil and gas production activities from the Sakhalin-2, North West Shelf, Pluto LNG Train 1 (Woodside), Qatargas 4 and Pearl GTL projects are included in integrated gas earnings. Power generation and coal gasification activities are also part of integrated gas.

The Prelude floating LNG (FLNG), the Gorgon LNG Trains 1-3 and the MMLS LNG (Elba) projects are currently under construction and expected to come on stream within the next few years.

Shell is also considering LNG options to monetise natural gas in North America. These would be projects that involve the entire natural gas value chain and so play very much to Shell’s strengths as an integrated player.

The Repsol LNG portfolio acquisition in late 2013 is another growth leg for integrated gas, with new equity supply in South America, and new trading opportunities.