| Download XLS |

|

KEY STATISTICS | |||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

2014 |

2013 |

2012 |

2011 |

2010 | ||||

|

|||||||||

|

Downstream CCS earnings ($ million) |

|

|

|

|

|

||||

|

Oil products |

1,994 |

2,026 |

4,008 |

2,136 |

1,439 |

||||

|

Chemicals |

1,417 |

1,843 |

1,374 |

2,034 |

1,511 |

||||

|

Total Downstream earnings ($ million) |

3,411 |

3,869 |

5,382 |

4,170 |

2,950 |

||||

|

Total Downstream earnings excluding identified items ($ million) |

6,265 |

4,466 |

5,343 |

4,155 |

3,873 |

||||

|

Downstream cash flow from operations ($ million) |

11,292 |

7,903 |

11,111 |

4,921 |

1,961 |

||||

|

Oil products sales volumes (thousand b/d) |

6,365 |

6,164 |

6,235 |

6,196 |

6,460 |

||||

|

Chemicals sales volumes (thousand tonnes) |

17,008 |

17,386 |

18,669 |

18,831 |

20,653 |

||||

|

Refinery processing intake (thousand b/d) |

2,903 |

2,915 |

2,819 |

2,845 |

3,197 |

||||

|

Refinery availability (%) |

94 |

92 |

93 |

92 |

92 |

||||

|

Chemical plant availability (%) [A] |

85 |

92 |

91 |

89 |

92 |

||||

|

Downstream capital investment ($ million) [B] |

5,910 |

5,528 |

5,454 |

7,548 |

4,759 |

||||

|

Downstream capital employed ($ million) |

48,925 |

64,507 |

62,426 |

64,237 |

61,789 |

||||

|

Downstream employees (thousands) |

47 |

48 |

48 |

51 |

59 |

||||

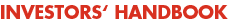

Downstream CCS earnings and net cash from operating activities [A] $ billion

- [A]

- CCS earnings excluding identified items.

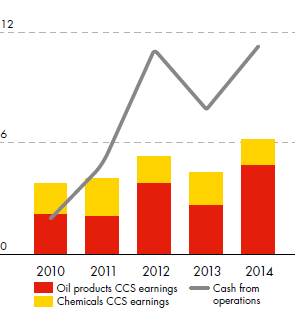

Global brand preference %

Source: Ipsos market research – Shell customer tracker survey program (33 markets covered 2012 to 2014).

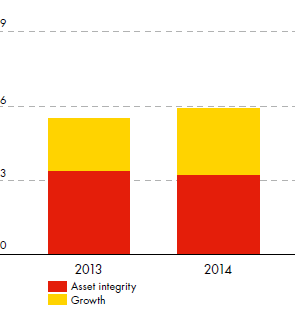

Downstream capital investment $ billion