| Download XLS |

|

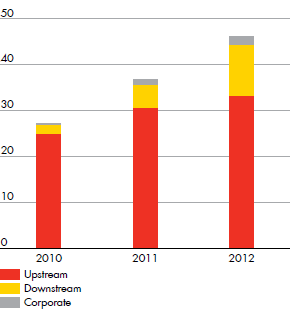

SUMMARY OF RESULTS |

$ MILLION | ||||

|---|---|---|---|---|---|

|

|

2012 |

2011 |

2010 |

2009 |

2008 |

|

Upstream |

22,162 |

24,455 |

15,935 |

8,354 |

26,506 |

|

Downstream (current cost of supplies |

5,350 |

4,289 |

2,950 |

258 |

5,309 |

|

Corporate and non-controlling interest |

(468) |

(119) |

(242) |

1,192 |

(449) |

|

CCS earnings |

27,044 |

28,625 |

18,643 |

9,804 |

31,366 |

|

Estimated CCS adjustment |

(452) |

2,293 |

1,484 |

2,714 |

(5,089) |

|

Income attributable to shareholders |

26,592 |

30,918 |

20,127 |

12,518 |

26,277 |

|

Identified items |

1,905 |

3,938 |

570 |

(1,749) |

2,956 |

|

CCS earnings excluding identified items |

25,139 |

24,687 |

18,073 |

11,553 |

28,410 |

|

Basic CCS earnings per share ($) |

4.32 |

4.61 |

3.04 |

1.60 |

5.09 |

|

Estimated CCS adjustment per share ($) |

(0.07) |

0.37 |

0.24 |

0.44 |

(0.82) |

|

Basic earnings per €0.07 |

4.25 |

4.98 |

3.28 |

2.04 |

4.27 |

|

Basic earnings per ADS ($) |

8.50 |

9.96 |

6.56 |

4.08 |

8.54 |

|

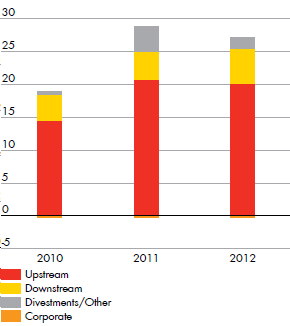

Net cash from operating activities |

46,140 |

36,771 |

27,350 |

21,488 |

43,918 |

|

Cash flow from operating activities |

7.37 |

5.92 |

4.46 |

3.51 |

7.13 |

|

Dividend per share ($) |

1.72 |

1.68 |

1.68 |

1.68 |

1.60 |

|

Dividend per ADS ($) |

3.44 |

3.36 |

3.36 |

3.36 |

3.20 |

CCS EARNINGS$ billion

NET CASH FROM OPERATING ACTIVITIES$ billion