Underpinned by our core values

and our focus on safety

Our tax strategy

When we invest in a country or location, we seek to build long-term relationships and develop our business sustainably. We recognise our responsibility towards investors, governments, employees and the local communities we are part of. The taxes we collect and pay are one of the ways we fulfil this responsibility.

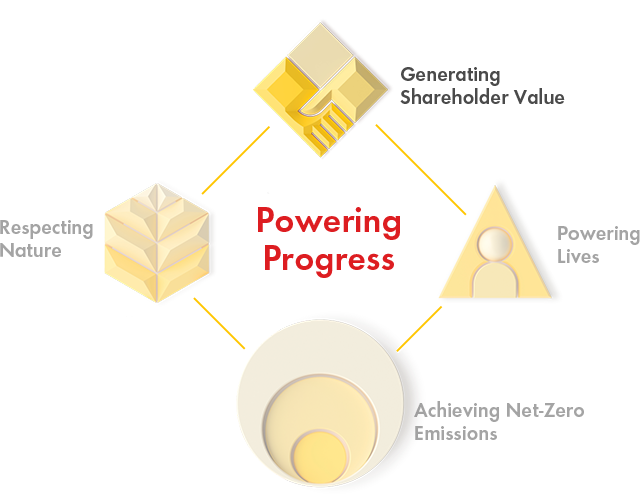

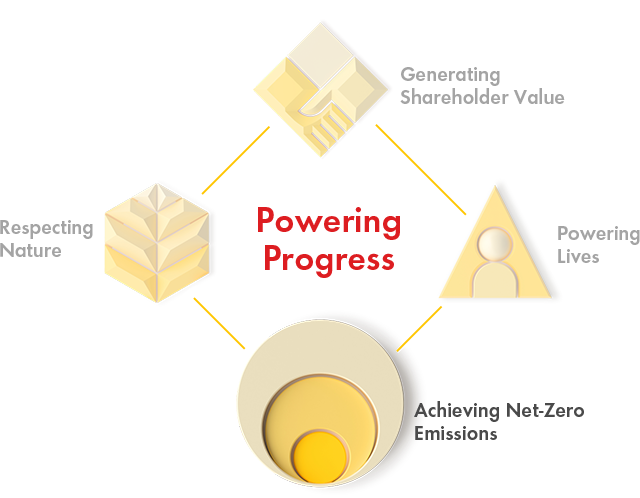

Our tax strategy is designed to support Shell in delivering our Powering Progress strategy. We provide our support through our commitment to compliance, transparency and open dialogue with our stakeholders, from governments to civil society. Our strategy and actions reflect our Shell values and principles.

The Board of Directors of Shell plc approves our tax strategy, regularly reviews its effectiveness and maintains a sound system of risk management and internal control.

The Executive Vice President Taxation is responsible for tax matters and provides assurance based on our tax control framework. The Audit Committee [A] assists the Board in maintaining a sound system of risk management and internal control and oversight over Shell's financial reporting. A variety of standing matters and more specific topics are discussed by the Audit Committee throughout the year. Annually the Board conducts a review, to its satisfaction, of the effectiveness of Shell's system of risk management and internal controls which includes financial, operational and compliance controls, including tax controls.

[A] As of July 1, 2023, the Audit Committee is called the Audit and Risk Committee.