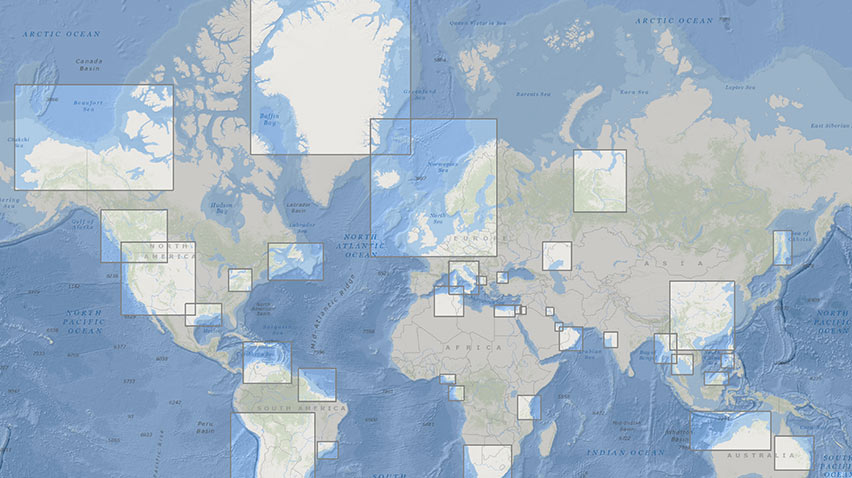

North America

Canada

We have approximately 1,600 mineral leases in Canada, mainly in Alberta and British Columbia. We produce and market natural gas, natural gas liquids, synthetic crude oil and bitumen. In addition, we have significant exploration acreage offshore.

Shales

We continued to develop fields in Alberta and British Columbia during 2016 through drilling programmes and investment in infrastructure to facilitate new production. We own and operate natural gas processing and sulphur-extraction plants in Alberta and natural gas processing plants in British Columbia. Our investment focus remains on liquid-rich shale assets in Alberta. As part of that focus, we sold shale gas assets located in Deep Basin East and Gundy in November 2016.

Bitumen and synthetic crude oil

Bitumen is a very heavy crude oil produced through conventional methods as well as through enhanced oil recovery methods. We produce and market bitumen in the Peace River area of Alberta. We also have heavy oil resources in approximately 1,200 square kilometres of the Grosmont oil sands area, also in northern Alberta. We retain Carmon Creek leases to preserve future options.

Synthetic crude oil is produced by mining bitumen-saturated sands, extracting the bitumen from the sands and transporting it to a processing facility where hydrogen is added to produce a wide range of feedstocks for refineries. We operate the Athabasca Oil Sands Project (AOSP) in north-east Alberta as part of a joint arrangement (Shell interest 60%). The bitumen is transported by pipeline for processing at the Scotford Upgrader, which is located in the Edmonton area. We also have a number of other minable oil sands leases in the Athabasca region with expiry dates ranging from 2018 to 2025. By completing the Alberta Department of Energy’s development requirements prior to their expiry, leases may be extended.

In March 2017, Shell agreed to sell to Canadian Natural Resources Limited (Canadian Natural) its 60% interest in the Athabasca Oil Sands Project (AOSP), accounted for as a joint operation, its 100% interest in the Peace River Complex in-situ assets including Carmon Creek, and a number of undeveloped oil sands leases, all in Alberta, Canada. The consideration is approximately $8.5 billion, comprising $5.4 billion in cash and around 98 million Canadian Natural shares currently valued at $3.1 billion. The transaction is estimated to result in a post-tax impairment loss of $1.3 billion to $1.5 billion, subject to adjustments. In a related transaction, Shell and Canadian Natural have agreed to jointly (50:50) acquire Marathon Oil Canada Corporation (MOCC), which has a 20% interest in the AOSP, for $1.25 billion each. Following these transactions, Shell will continue as operator of the Scotford Upgrader and the Quest carbon capture and storage (CCS) project. Subject to regulatory approvals, the transactions are expected to close in mid-2017. Subject to closing of these transactions and additional further conditions, Shell may swap its purchased interest in MOCC for a 20% interest in the Scotford Upgrader and Quest CCS project. If the swap were to occur, Shell would fully exit AOSP mining operations and have a 20% interest in the Scotford Upgrader and Quest CCS project.

Carbon capture and storage (CCS)

Worker bundling casing for inspection at the Shelburne Basin Venture, Shore Base Dockyard, Canada.

In 2015, we launched our Quest CCS project in Canada, which captured and safely stored more than 1 million tonnes of CO2 in 2016.

Offshore

We have a 31.3% interest in the Sable Offshore Energy project, a natural-gas complex off the east coast of Canada, and other acreages in deep-water offshore Nova Scotia and Newfoundland. We have a 50% interest and operatorship in the Shelburne exploration project offshore Nova Scotia. We also have a number of exploration licences off the west coast of British Columbia and in the Mackenzie Delta in the Northwest Territories.

USA

We produce oil and gas in deep water in the Gulf of Mexico, heavy oil in California and oil and gas from shale in Pennsylvania, Texas and Louisiana. The majority of our oil and gas production interests are acquired under leases granted by the owner of the minerals underlying the relevant acreage, including many leases for federal onshore and offshore tracts. Such leases usually run on an initial fixed term that is automatically extended by the establishment of production for as long as production continues, subject to compliance with the terms of the lease (including, in the case of federal leases, extensive regulations imposed by federal law).

Gulf of Mexico

The Gulf of Mexico is our major production area in the USA and accounts for more than 62% of our oil and gas production in the country. We have an interest in approximately 400 federal offshore production leases and our share of production averaged 248 thousand boe/d in 2016.

We are the operator of eight production hubs: Mars A, Mars B, Auger, Perdido, Ursa, Enchilada/Salsa, Ram Powell and Stones, as well as the West Delta 143 Processing Facilities (Shell interest ranging from 38% to 100%). We also have non-operating interests in Nakika (Shell interest 50%) and Caesar Tonga (Shell interest 22.5%), and the Coulomb field (Shell interest 100%).

During 2016, the Stones field came on stream with Shell’s first FPSO in the Gulf of Mexico. We also began drilling operations at the Appomattox field. Construction of the facilities and export pipeline continues with first oil expected in 2019.

In 2016, we sold our 100% interest in the Brutus TLP, the Glider subsea production system, and the oil and gas pipelines used to transport the production from the TLP. Additionally, we sold a 20% interest in the Kaikias development in the Gulf of Mexico. We retain an 80% interest and in February 2017 we we took the FID to execute Phase 1 of the project.

Onshore

We have significant shale acreage, focused in the Delaware Permian Basin in West Texas and the Marcellus and Utica plays in Pennsylvania. As a result of the acquisition of BG, we acquired a position in the Haynesville shale gas formation in Northern Louisiana, which is operated by EXCO Resources Inc.

California

We have a 51.8% interest in Aera Energy LLC (Aera) which operates approximately 15,000 wells in the San Joaquin Valley, mostly producing heavy oil and associated gas.

Alaska

We found indications of oil and gas in the Burger J well in the Chukchi Sea in 2015, but they were insufficient to warrant further exploration in the prospect and the well was deemed a dry hole. The well was sealed and abandoned in accordance with US regulations.

During the summer of 2016, contractors safely collected the remaining equipment used for our prior offshore exploration and drilling operations, and successfully conducted Phase 4 of the drilling discharge monitoring process in accordance with federal Environmental Protection Agency requirements.

In 2016, we relinquished all but one federal lease in the Chukchi Sea and half of our federal leases in the Beaufort Sea. We concluded a commercial deal to transfer 21 Beaufort federal leases to the Arctic Slope Regional Corporation. We also transferred operatorship of our remaining federal leases (Shell interest 40%) in the Beaufort Harrison Bay area to ENI. We retain 18 state leases nearby and continue to evaluate all our Beaufort holdings for commercial options. The BG acquisition added an onshore gas portfolio in the Alaska Foothills, in which we now have a 33% non-Shell-operated interest along with Anadarko and Suncor. We continue to evaluate options for this portfolio.

Rest of North America

We also have interests in Honduras.