Upstream overview

Conventional oil and gas

Cash engine

Deep water

Growth priority

Shales

Future opportunity

Milestones in 2016

- Following the acquisition of BG in February 2016, we completed the integration of BG assets into our portfolio.

- Also in early 2016, in the United Arab Emirates, we decided to exit the joint development of the Bab sour gas reservoirs (Shell interest 40%) with Abu Dhabi National Oil Company (ADNOC) in the emirate of Abu Dhabi, and to stop further work on the project.

- In Brazil, the seventh, eighth and ninth floating production, storage and offloading facilities (FPSO) – Cidade de Maricá, (Shell interest 25%, production capacity of 150 thousand boe/d), Cidade de Saquarema (Shell interest 25%, production capacity of 150 thousand boe/d) and Cidade de Caraguatauba (Shell interest 30%, production capacity of 100 thousand boe/d) respectively – achieved first oil in various offshore blocks.

- In Brunei, the non-Shell-operated ML South development (Shell interest 35%) achieved first production. The expected peak production from this development is around 40 thousand boe/d.

- In Kazakhstan, first crude oil was exported on October 29, 2016, and the Commencement of Commercial Production milestone was achieved on November 1, 2016, from the non-Shell-operated Kashagan development (Shell interest 16.8%).

- In Malaysia, we started production from the Malikai tension leg platform (TLP) (Shell interest 35%), located 100 kilometres off the coast of the state of Sabah. Malikai is expected to reach a peak production of 60 thousand boe/d.

- In the USA, we started production at the Stones development (Shell interest 100%) in the Gulf of Mexico. Stones is expected to produce around 50 thousand boe/d when fully ramped up at the end of 2017.

We continued to divest selected assets during 2016, including:

- In Canada, we sold our interest in 145 thousand net acres in the Deep Basin acreage and 61 thousand net acres in the Gundy acreage.

- In the USA, we sold our 100% interest in the Brutus TLP, the Glider subsea production system, and the oil and gas pipelines used to transport the production from the TLP.

- Also in the USA, we sold a 20% interest in the Kaikias development in the Gulf of Mexico. We retain an 80% interest.

- In Malaysia, we agreed to sell our 50% interest in the 2011 North Sabah EOR Production Sharing Contract in Malaysia, subject to obtaining regulatory and partner approval.

Additionally, in 2017

- In January, we agreed to sell our interests in some of our UK North Sea assets, for up to $3.8bn. The transaction is subject to partner and regulatory approvals, with completion expected in 2017.

- In March, we agreed to sell all of our in-situ and undeveloped oil sands interests in Canada, and reduce our interest in the Athabasca Oil Sands Project (AOSP), for a net consideration of $7.25 billion. Upon completion, we will continue as operator of the Scotford Upgrader and Quest carbon capture and storage (CCS) project. The transactions are expected to close in mid-2017, subject to customary closing conditions, adjustments and regulatory approvals.

|

Upstream key statistics | |||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

2016 |

2015 |

2014 |

2013 |

2012 | ||||

|

|||||||||

|

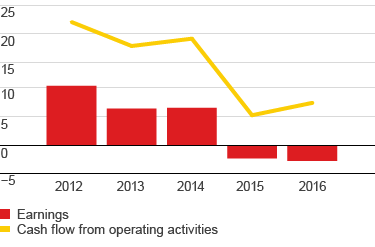

Earnings ($ million) |

(3,674) |

(8,833) |

5,231 |

3,640 |

11,254 |

||||

|

Earnings excluding identified items ($ million) |

(2,704) |

(2,255) |

6,754 |

6,644 |

10,693 |

||||

|

Cash flow from operating activities ($ million) |

7,662 |

5,453 |

19,150 |

17,841 |

22,131 |

||||

|

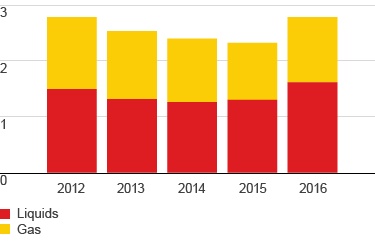

Liquids production (thousand b/d) [A] |

1,615 |

1,305 |

1,263 |

1,317 |

1,495 |

||||

|

Natural gas production (million scf/d) [A] |

6,781 |

5,911 |

6,593 |

7,059 |

7,488 |

||||

|

Total production (thousand boe/d) [A][B] |

2,784 |

2,323 |

2,399 |

2,534 |

2,786 |

||||

|

Capital investment ($ million) |

47,507 |

18,349 |

22,169 |

28,481 |

25,102 |

||||

|

Capital employed ($ million) |

128,782 |

84,727 |

88,692 |

93,135 |

87,413 |

||||

|

Employees (thousands) |

22 |

22 |

22 |

21 |

N/A |

||||

Upstream earnings and cash flow [A]

$ billion

[A] Earnings excluding identified items.

Production available for sale

mboe/d