Introduction from the CEO

“We are working to reshape Shell into a more focused and resilient company”

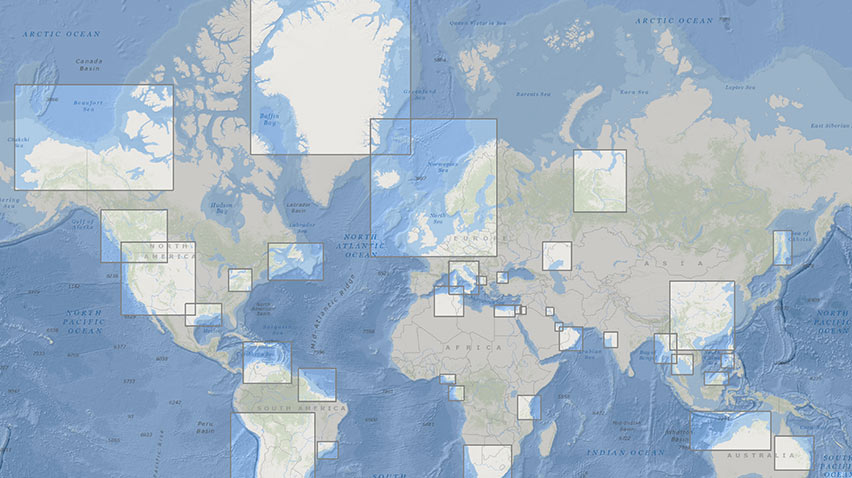

This Investors' Handbook gives an overview of our global operations, shows how Shell has performed over the last five years and sets out our plans for the future.

The acquisition and integration of BG Group plc (BG), which we have now completed, has been an important growth accelerator and a catalyst for the changes we are making to our work practices, cost structure and portfolio. The global portfolio acquired with BG, combined with the major deep-water projects we started up in 2016, have greatly strengthened Shell.

The oil and gas market outlook remains uncertain, but our strict capital discipline, substantial cost savings and integrated business model are helping support earnings and cash flow generation.

We continue to streamline our Downstream business as part of our ongoing effort to improve efficiency by lowering costs and concentrating on our most competitive positions. We have also sold several large Upstream assets, including in the Gulf of Mexico and in Canada. Our divestment drive gained real momentum in 2016 and we plan to continue to sell assets in 2017 as part of our overall divestment programme of $30 billion for 2016-18.

Despite the challenging market environment, it is important that we continue to invest in the most competitive projects. That is why we took final investment decisions on petrochemicals projects in China and the USA in 2016 and a deep-water project in the US Gulf of Mexico in early 2017.

But we are working to reshape Shell into a more focused and resilient company by capping our investments for the next few years, while continuing to drive down costs and to sell assets.

Following the integration of BG, our Integrated Gas business has become an engine for generating cash and returns. Our greatly enhanced global gas business, combined with our other cash engines, should deliver rising free cash flow from around 2020. We plan to continue prioritising growth in our deep-water and chemicals businesses beyond 2020.

We expect demand for oil and gas to continue to grow, but we also intend to build upon our portfolio and will continue to look at the potential of low-carbon biofuels, hydrogen, solar and wind as the transition to a lower-carbon global energy system unfolds. That is why we created a New Energies business in 2016. We intend to act with conviction and commercial realism in this area, when the value for shareholders and society is clear.

We revitalised Shell in 2016 and I am confident that 2017 will be another year of progress in building our world-class investment case.

Ben van Beurden

Chief Executive Officer