LNG

Shell is involved in every stage of the LNG value chain. We find gas fields, extract and liquefy gas, trade and ship LNG, and turn it back into gas before distributing it to customers. In February 2016, Shell completed its acquisition of BG. This deal underscores Shell’s role as a large independent, international trader and marketer in LNG.

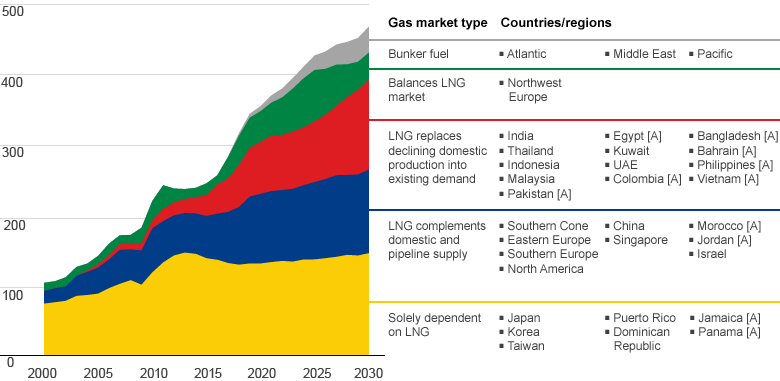

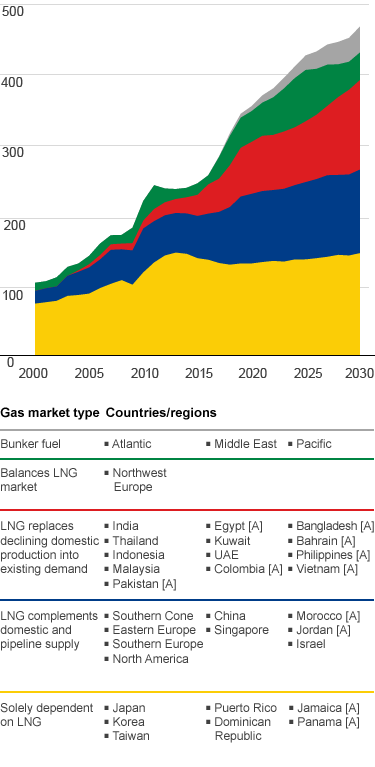

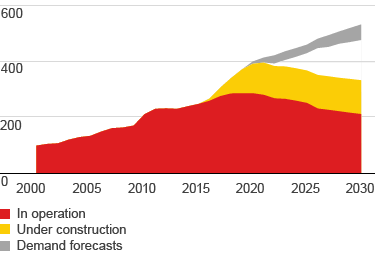

Gas has been the fastest-growing hydrocarbon over the past decade and demand has increased by around 2% per year since 2000. The number of countries importing LNG stands at 35, up from around 10 at the start of the century. Global LNG demand has grown at an estimated annual average rate of 6% since 2000, reaching 265 million tonnes (MT) in 2016. That is enough to generate electricity for around 500 million homes a year.

2016 saw strong growth in LNG supply. The bulk of growth came from Australia, where exports increased by 15 MT to a total of 44.3 MT.

Between 2015 and 2030, LNG demand is expected to rise 4–5% per year (see Shell LNG Outlook). More countries now have the necessary infrastructure in place and LNG will increasingly be used when there are shortages in domestic energy supply.

LNG use beyond the power sector is expected to continue rising. Over the next decade, LNG use in the heavy-duty road and marine transport sectors is expected to grow in the Middle East, Europe, Southeast Asia and the USA, driven in part by tighter emissions regulations.

In Southeast Asia, Malaysia and Indonesia are significant LNG exporters. But the region is set to become a net importer by 2035. The rise in LNG demand is driven by economic growth coupled with declining domestic gas supplies.

Between 2014 and 2020, the size of global LNG trade is expected to grow by 50%, mainly from LNG facilities already under construction or recently completed.

The vast majority of Shell’s LNG portfolio is sold on long-term contracts, ranging from two to 20 years, linked to oil and gas-hub prices. Some volumes are sold on a short-term basis and these sales mostly offset our spot market purchases.

Shell plays an aggregator role in the global LNG market whereby, on top of our own liquefaction volumes, we buy LNG under long-term contracts from other suppliers, often from our joint venture partners, and market it to customers around the world. We also buy and sell LNG on the spot market to further enhance our business through logistic or market optimisations. Our large global portfolio of diverse sources and market positions helps optimise this business.

In 2016, Shell was appointed as one of the aggregators for the next tranche of LNG into Singapore, further demonstrating the value of BG in our portfolio. This built on the existing customer relationship in Singapore‘s gas market and Shell’s downstream gas demand, while offering flexible and competitive terms to the market.

We are actively developing new markets and outlets for our gas. We have capacity rights for a total of around 40 million tonnes per annum (mtpa) in 10 regasification terminals around the world and are actively pursuing additional opportunities. For example, we saw demand in three new LNG-importing countries grow rapidly: Egypt, Pakistan and Jordan. Egypt and Pakistan effectively used LNG to replace existing domestic gas supply, taking advantage of floating storage and regasification units (FSRUs) which turn LNG back into gas offshore then pipe it into the country’s grid. A recent successful example of creating new markets is Gibraltar, where Shell will supply LNG for power generation through a new small-scale LNG supply chain.

LNG for transport

The world needs cleaner vehicles and fuels to meet the increasing demand for transport with lower emissions. LNG is emerging as a cost-competitive and cleaner burning fuel for shipping, heavy-duty road transport, and industrial applications. We estimate that LNG for transport could add around 25-45 mtpa to global demand by 2025.

Shell has access to import and storage capacity at the GATE LNG terminal in the Netherlands, allowing the company to supply LNG to marine and road transport customers in northwest Europe. Shell is building an innovative bunker vessel with a capacity of around 6,500 cubic metres to facilitate ship-to-ship transfers of LNG. The vessel will load LNG from the Gate terminal and deliver it to marine customers in Europe.

For road customers, the existing truck-loading station at the Gate terminal will be used to distribute LNG fuel to a growing Shell network of LNG truck refuelling stations in the Netherlands. The first five of these Shell truck refuelling stations are open for business in Rotterdam, Waalwijk, Pijnacker, Amsterdam, and Eindhoven.

In 2016, Shell signed an agreement with the world’s biggest cruise operator, Carnival, to supply LNG to fuel two of the world’s largest passenger cruise ships. These will be the world’s first LNG-powered cruise ships and are due to start sailing in north-west Europe and the Mediterranean in 2019.

In 2016, the Port Authority of Singapore announced that BG Group – now part of Shell – and Keppel Offshore & Marine Ltd won a bid for Singapore's first licence to fuel ships with LNG. In October 2016, the Singapore Energy Market Authority appointed Shell to import the next tranche of LNG for Singapore. Shell will have an exclusive franchise until 2020.

Global LNG supply + demand outlook

mtpa

Liquefaction capacity

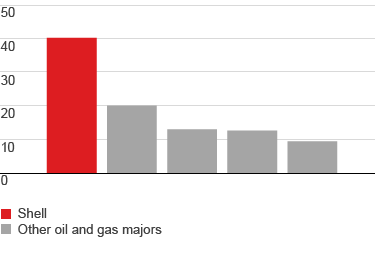

Capacity at end of 2016, in mtpa