Overall highlights in 2016

CCS earnings

$7.2 billion

excluding identified items

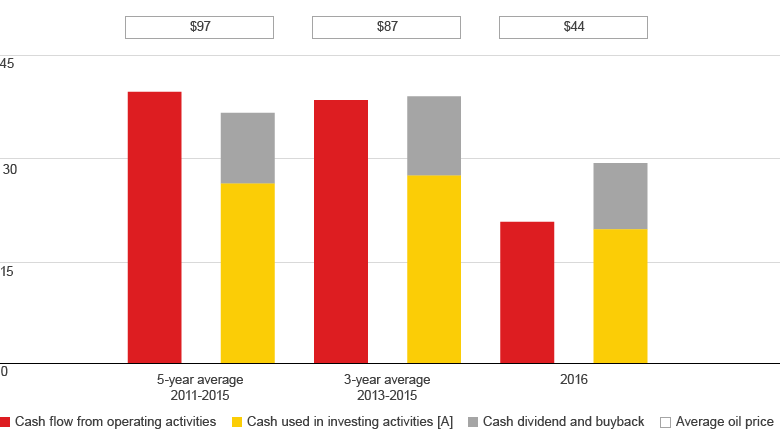

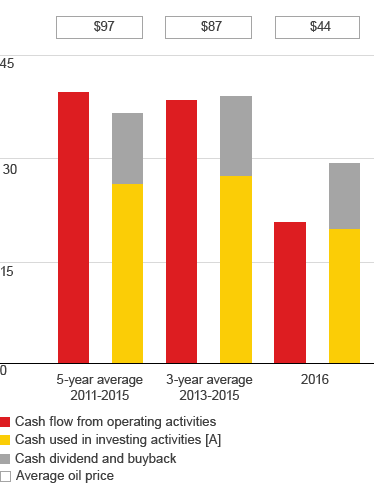

Cash flow from operating activities

$20.6 billion

Total dividends distributed

$15.0 billion

of which $5.3 billion were settled under the Scrip Dividend Programme

Gearing

28.0 %

Divestments

$4.7 billion

Major project startups

8

Organic capital investment

$26.9 billion

Underlying operating expenses

$38.3 billion

BG Acquisition

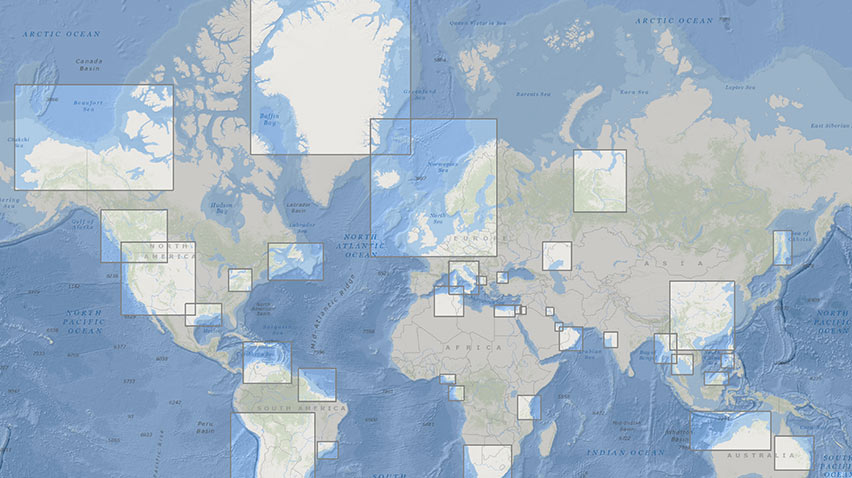

The successful completion of our acquisition of BG was a transformational step for Shell. It is a bold and compelling stride forward in our LNG and deep-water growth strategy. The overarching goal of buying BG was to create value for shareholders. The effective integration of BG into our portfolio, which has now been completed, will help deliver that value and accelerate the reshaping of Shell into a world-class investment. The foundations for building this investment case are now set.

Portfolio additions

Key portfolio events in 2016 included the following:

- Shell was appointed to provide up to 1 million tonnes per annum (mtpa) of LNG to Singapore for the next three years.

- We signed an agreement to construct a regasification unit to provide gas for power generation in Gibraltar.

- We took the final investment decision (FID) to expand our 50:50 joint venture with China National Offshore Oil Corporation (CNOOC) in China, to increase ethylene capacity by more than 1 mpta when fully completed.

- We took the FID to build a major petrochemicals complex in Pennsylvania, USA.

Shell is being highly selective on new investment decisions and we plan to continue this approach throughout 2017.

Start-ups

We started up eight major projects in Australia, Brazil, Kazakhstan, Malaysia and the USA. We expect these projects to add more than 250 thousand barrels of oil equivalent per day to our production and add 3.9 mtpa to our LNG liquefaction capacity, once fully ramped up. An extensive overview is provided in the project delivery section.

Divestments

We continued to divest assets that fail to deliver competitive performance or no longer meet our longer-term strategic objectives. Divestments in Japan, Denmark and Malaysia helped streamline our Downstream businesses. We also sold part of our interests in Shell Midstream Partners, L.P. and Pilipinas Shell Petroleum Corporation, while retaining control of both. In Upstream, we sold assets in the Gulf of Mexico and in Canada.

Our divestment drive gained momentum during the year and we plan to continue to sell assets in 2017 as part of our overall divestment programme of $30 billion for the 2016-18 period.