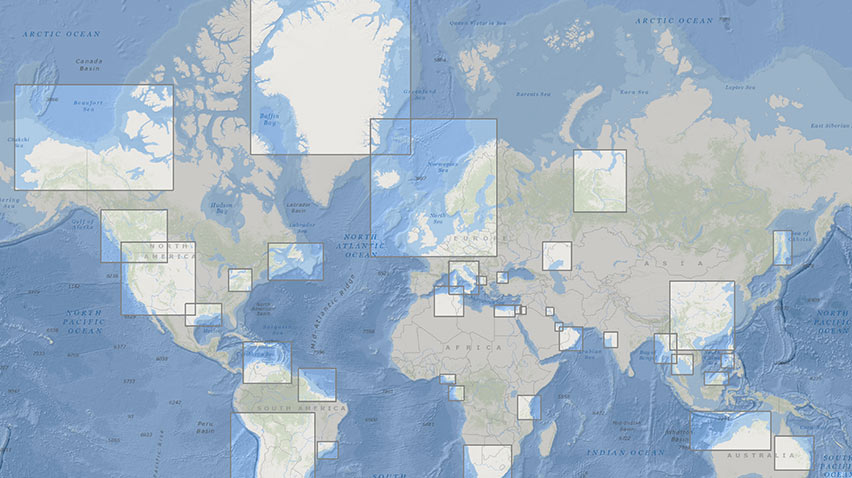

Asia (including Middle East and Russia)

Brunei

We have a 25% interest in Brunei LNG Sendirian Berhad which sells most of its LNG on long-term contracts to customers in Asia.

China

We jointly develop and produce from the onshore Changbei tight-gas field under a production-sharing contract (PSC) with China National Petroleum Corporation (CNPC). In 2016, we completed the Changbei I development programme under the PSC and subsequently handed over the production operatorship to CNPC. We also completed drilling appraisal wells for Changbei II Phase I under the PSC, and have submitted a development plan to CNPC.

In Sichuan, we completed a significant drilling programme in all three blocks in 2016, in accordance with provisions of the PSCs with CNPC. The geology is challenging and the mixed evaluation results do not justify further investment.

We also have a 49% interest in an offshore oil and gas block in the Yinggehai basin, under a PSC with China National Offshore Oil Corporation (CNOOC). Based on the results from the second deep-water exploration well, LD11-1-1 block 62/17, we decided not to pursue this opportunity further.

Worker doing a routine inspection at the Hazira LNG receiving and regasification terminal, a joint venture between Shell and Total, in India.

India

As a result of the acquisition of BG, we have a 30% interest in each of the producing oil and gas fields Panna/Mukta, Mid Tapti and South Tapti. The Tapti fields ceased production in the first quarter of 2016.

Also as a result of the acquisition, we gained a 49.75% interest in MGL, a natural gas distribution company in Mumbai. As result of an initial public offering, our interest was reduced to 32.5% in June 2016.

Hazira is a regasification terminal, in which we have a 74% interest, in the state of Gujarat, on the west coast of India.

Indonesia

We have a 35% interest in the INPEX Masela Ltd joint venture which owns and operates the offshore Masela block. In April 2016, the joint venture received a notification from the Indonesian government authorities instructing it to re-propose a plan for the Abadi gas field based on an onshore LNG project. The partners are committed to working together with the Indonesia government to move the project forward.

Malaysia

We have a 15% interest in Malaysia LNG Tiga located in Bintulu. We also operate a GTL plant, Shell MDS (Shell interest 72%), adjacent to the Malaysia LNG facilities. Using Shell technology, the plant converts gas into high-quality middle distillates, drilling fluids, waxes and specialty products.

Oman

We have a 30% interest in Oman LNG, which mainly supplies Asian markets under long-term contracts. We also have an 11% interest in Qalhat LNG, which is part of the Oman LNG complex.

Qatar

We operate the Pearl GTL plant (Shell interest 100%) in Qatar under a development and production-sharing contract with the government. The fully-integrated facility has capacity for production, processing and transportation of 1.6 billion standard cubic feet per day (scf/d) of gas from Qatar’s North Field. It has an installed capacity of about 140 thousand boe/d of high-quality liquid hydrocarbon products and 120 thousand boe/d of NGL and ethane. In 2016, Pearl GTL produced 5 million tonnes of GTL products.

We have a 30% interest in Qatargas 4, which comprises integrated facilities to produce about 1.4 billion scf/d of gas from Qatar’s North Field, an onshore gas-processing facility and one LNG train with a collective production capacity of 7.8 mtpa of LNG and 70 thousand boe/d of condensate and NGL.

Russia

We have a 27.5% interest in Sakhalin-2, an integrated oil and gas project located in a subarctic environment.

We have a 50% interest in the Salym fields in western Siberia, Khanty Mansiysk Autonomous District, where production was approximately 125 thousand boe/d in 2016.

As a result of European Union and US sanctions prohibiting certain defined oil and gas activities in Russia, we suspended our shale oil exploration activities undertaken through Salym and Khanty-Mansiysk Petroleum Alliance in 2014.

Singapore

In 2016, Shell and Keppel Offshore & Marine secured the licence to supply LNG fuel for vessels in the Port of Singapore after submitting a joint bid to the Maritime and Port Authority of Singapore. With the granting of the licence, Shell and Keppel have formed a 50:50 joint venture to fuel ships with LNG. We currently have an exclusive role as the aggregator of LNG demand for the Singapore market. In October 2016, we won a licence to import a further 1 mtpa, starting in 2017.

Thailand

As a result of the acquisition of BG, we have a 22.2% interest in the Bongkot and G12/48 fields in the Gulf of Thailand and a 66.7% interest in exploration Blocks 7 and 8, where activity is currently suspended due to overlapping claims by Thailand and Cambodia. We have an agreement over Block 9a under which we receive royalties. The Bongkot field meets around 20% of the country’s gas demand.

In January 2017, we reached an agreement with KUFPEC Thailand Holdings Pte Limited, for the sale of our interests in the Bongkot and G12/48 fields.