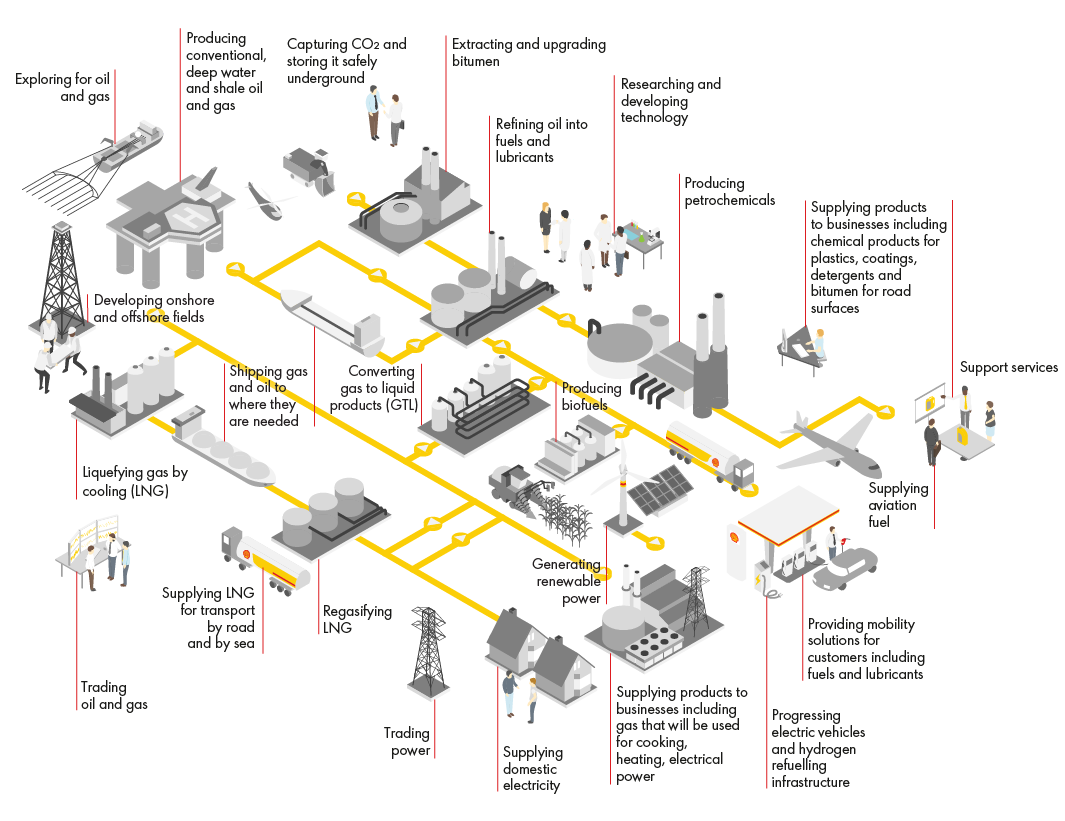

Our business activities

Key figures in 2018

Shell aims to meet the world’s growing need for more and cleaner energy solutions in ways that are economically, environmentally and socially responsible. Our global group of energy and petrochemical companies operates in many countries and locations and across the whole energy supply chain.

We have the following strategic ambitions:

- To deliver a world-class investment case. This involves growing free cash flow and increasing returns, all built upon a strong financial framework and resilient portfolio;

- To thrive in the energy transition by responding to society’s need for more and cleaner, convenient and competitive energy; and

- To sustain a strong societal licence to operate and make a positive contribution to society through our activities.

We describe below how our activities are organised into Integrated Gas and New Energies, Upstream, Downstream and Projects & Technology, which work together to help meet energy demand.

Shell business model

The business model, the stage in the investment cycle and business performance drives much of our taxes paid.

Our tax data reflect the varied nature of our activities. We have a large portfolio of assets and businesses in different countries and at different stages of the business cycle, from start-up to decommissioning.

Our business profits are closely linked to oil and gas prices and so are our taxes. When oil prices are lower, we expect a lower overall effective tax rate (ETR). When the oil price is higher, we see a greater proportion of profits being taxed at higher upstream tax rates. Further details on our ETR can be found in the 2018 Annual Report and Form 20-F.

Business activities are supported by centralised services, such as legal, human resources and others. For more details, see the chapter Supporting services.

Message from the Chief Financial Officer

Message from the Chief Financial Officer

Approach to tax

Approach to tax

Special topics

Special topics

Our tax data

Our tax data