Chief Executive Officer’s review

“The stark realities we are seeing globally reinforce the need for a balanced energy transition.”

It was more than a year ago that Russia invaded Ukraine, triggering a war that has killed thousands and continues to wreck the lives of many more. I hope and pray for an end to this devastating conflict that is threatening the security of Europe.

We continue to provide support to our staff in both countries and we are working with aid organisations in Ukraine and in bordering countries, where millions of refugees are now trying to rebuild their lives. In the days following the invasion, we announced our intention to withdraw from our Russian oil and gas activities in a phased manner, aligned with government guidance.

In 2022, the invasion and reduction of gas supply from Russia that followed accelerated a surge in global energy prices. This pushed up the cost of almost everything for households, industry, and businesses. Europe took positive actions to secure energy supply with Germany, for example, getting two floating regasification facilities up and running by the end of the year.

Shell also did its part, responding with agility as an energy provider. For example, we used our strength as a global energy producer and supplier to deliver 194 cargoes of liquefied natural gas to Europe and the UK – almost five times the usual average – and helped countries like Germany and Austria ensure they had enough energy storage ahead of their winter. I am proud of how our people stepped up when called upon.

As we publish our Annual Report, the tragic aftermath of devastating earthquakes in Turkey and Syria is still unfolding. We are supporting our staff in the region, and they are working hard to keep fuel supplies flowing to help relief efforts and keep hospitals operating.

The stark realities we are seeing globally reinforce the need for a balanced energy transition. They also show that our Powering Progress strategy is the right one: delivering secure and affordable energy with increasingly lower emissions. We must do this profitably as we help build the net-zero energy system of the future.

Generating shareholder value

In becoming Chief Executive Officer in January 2023, I succeeded Ben van Beurden, who was CEO for nine years. In that time Ben transformed Shell into a much stronger company and set us on the path to net-zero emissions. I am grateful to Ben for his work and for what he has handed over to me. In my first Annual Report as CEO, I want to be clear: Shell is a great company, and we are changing to ensure we become a great investment too.

In 2022, we made income of around $43 billion and our highest ever Adjusted Earnings of around $40 billion. While the global business environment for energy producers helped make this possible, our Adjusted Earnings were still around $17 billion higher than in 2014, when Brent prices were at similar levels. Thanks to improvements made over the past few years, the quality of our portfolio also makes us resilient to market volatility, and the streamlining of our organisation has made us more efficient.

We delivered a cash flow from operations of more than $68 billion and our organic free cash flow was around $48 billion. This strong performance allowed us to increase our distributions to shareholders and we returned around $26 billion to them through share buybacks and dividends, which is more than 35% of our cash flow from operations. We will continue to target shareholder distributions with a hard floor of 20%, and the option of more than 30%, of our cash flow from operations, subject to Board approval.

Profit without sustainability erodes our licence to operate. Sustainability without profit erodes our shareholder support and financial capacity to play a meaningful part in the energy transition. We must continue to provide energy and do it with fewer emissions. We can only do this with the backing of our shareholders because it is their capital that enables us to invest in the energy transition.

Investing to meet demand today and in the future

Performance and discipline

In 2022, there were significant improvements in both personal and process safety. The safety of our employees and contractors is paramount. Despite our best efforts, I am saddened to say that in 2022 two of our contractor colleagues died tragically, one in Nigeria and one in Pakistan. We will, as always, learn from these accidents and do our utmost to keep our people safe and unharmed.

While our 2022 financial performance was strong, we can do even better. We aim to be disciplined in allocating our capital by investing in the best oil and gas projects and making investments in the energy transition with a relentless focus on shareholder value and returns.

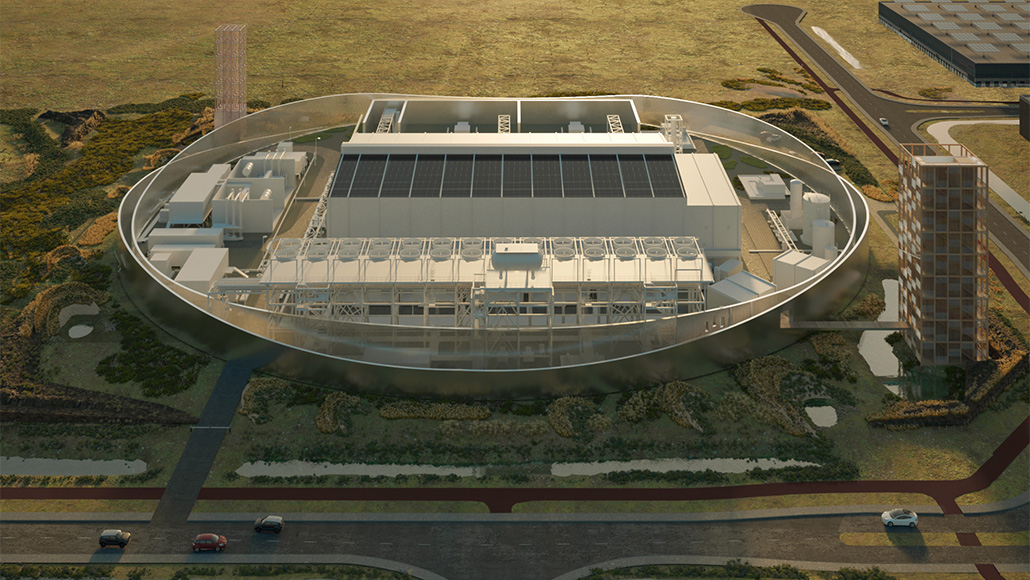

Our acquisition of Nature Energy, the largest producer of renewable natural gas in Europe, is a case in point. This is a transformative investment because Nature Energy will supply customers we already have, while giving us access to new customers who want low-carbon products. Another investment that promises value is our acquisition of Sprng Energy group, a solar and wind platform in India, which has added significant capacity to our renewable generation portfolio. We also took the final investment decision to build Holland Hydrogen 1 in the Netherlands, which will be Europe’s largest renewable hydrogen plant once operational from 2025.

In addition to this, our oil and gas activities are showing they can operate according to our belief that value is more important than volume. For example, our Vito deep-water oil platform, which produced first oil in February 2023 in the Gulf of Mexico, was redesigned to make the combined topsides and hull a third of the originally planned size and reduce costs by more than 70%.

As part of our efforts to improve our operating performance, all our businesses work within a rigorous capital and carbon budget. Shell will continue to apply capital discipline as we require directorates to adhere to our new carbon management framework, which sets limits for the emissions in each business.

In early 2023, I moved to simplify our business and leadership structure. By combining Integrated Gas with Upstream, and Renewables and Energy Solutions with the Downstream business, I believe we will be able to make faster, more focused decisions.

Balance and ingenuity

The energy transition must succeed, but balance is needed if society is to leave nobody behind. Trying to dismantle the current energy system before the new energy system is ready will lead to supply shortages and higher prices.

The transition must seek to ensure energy security, affordability and sustainability.

Shell is ready to play a role in a balanced transition, profitably and purposefully. As we delivered record profits for 2022, we also reduced carbon emissions from our operations by over 30%, compared with 2016, our reference year. This is more than halfway towards our target of a 50% reduction by 2030. We are also making progress in reducing our fresh-water consumption in water-stressed areas and focusing on chemical recycling.

As I take on the role of CEO, I am reminded of when I joined Shell some 25 years ago. I was attracted to its core values of honesty, integrity and respect for people. I believe those same values, along with Shell’s diverse and exceptional talent, our assets and capabilities, our brand and relationships, equip us well for the next phase of our journey. We can make a real difference in the world and create value for our shareholders by doing so.

Since my appointment was announced in September 2022, I have spent time with our teams in a number of countries, including Brazil, the Netherlands, Qatar, the UAE and the USA. I have drawn tremendous energy and pride from seeing the outstanding work that our people are engaged in every day. My single biggest contribution, along with my Executive Committee, will be to find ways to harness the collective energy and commitment that our 93,000 people possess.

Together, we have the ingenuity, talent and resilience to continue to transform our business into one that performs with increasing discipline, efficiency and excellence. We will unlock our potential, power progress, and help make this balanced energy transition happen.

Wael Sawan

Chief Executive Officer