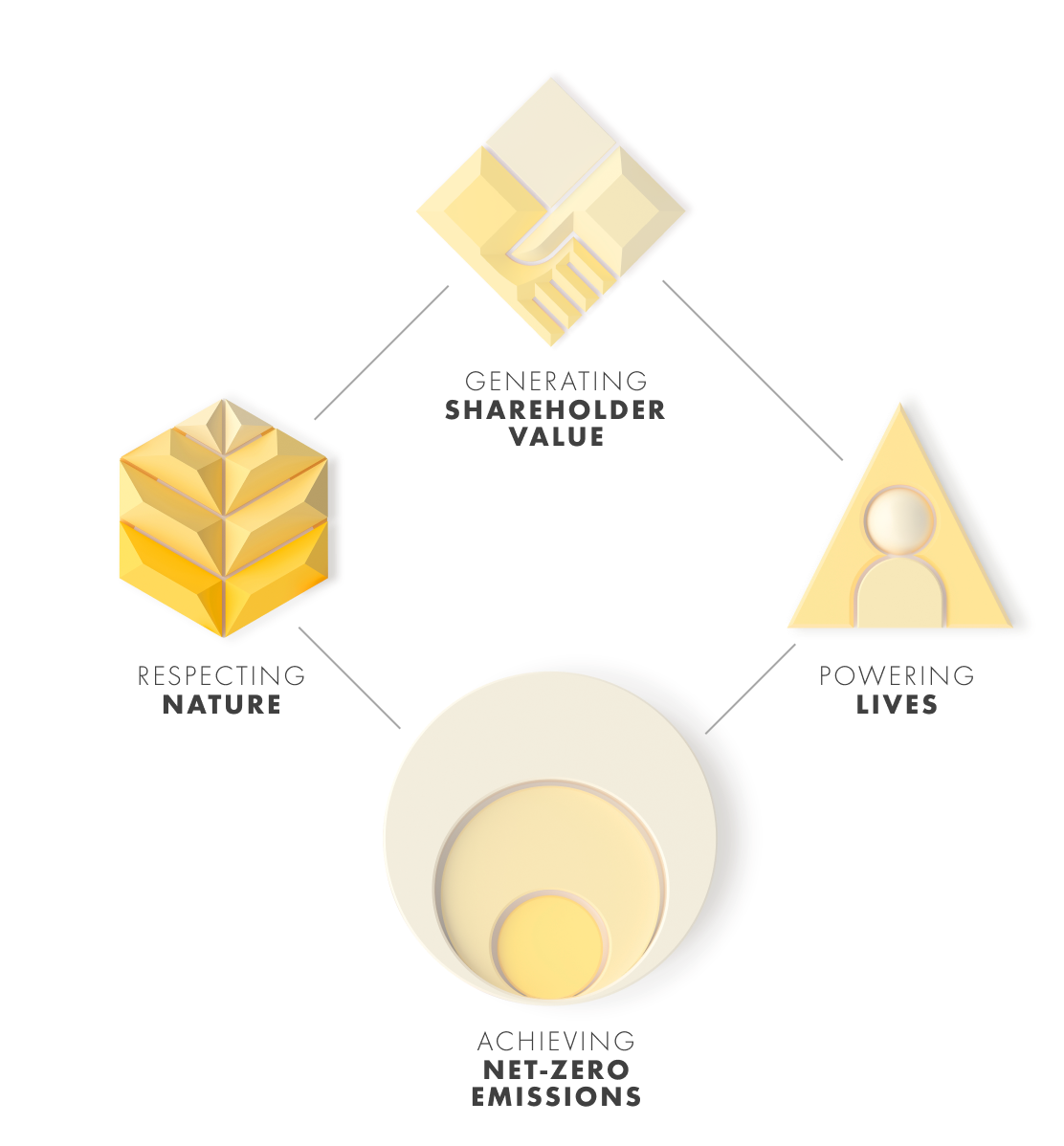

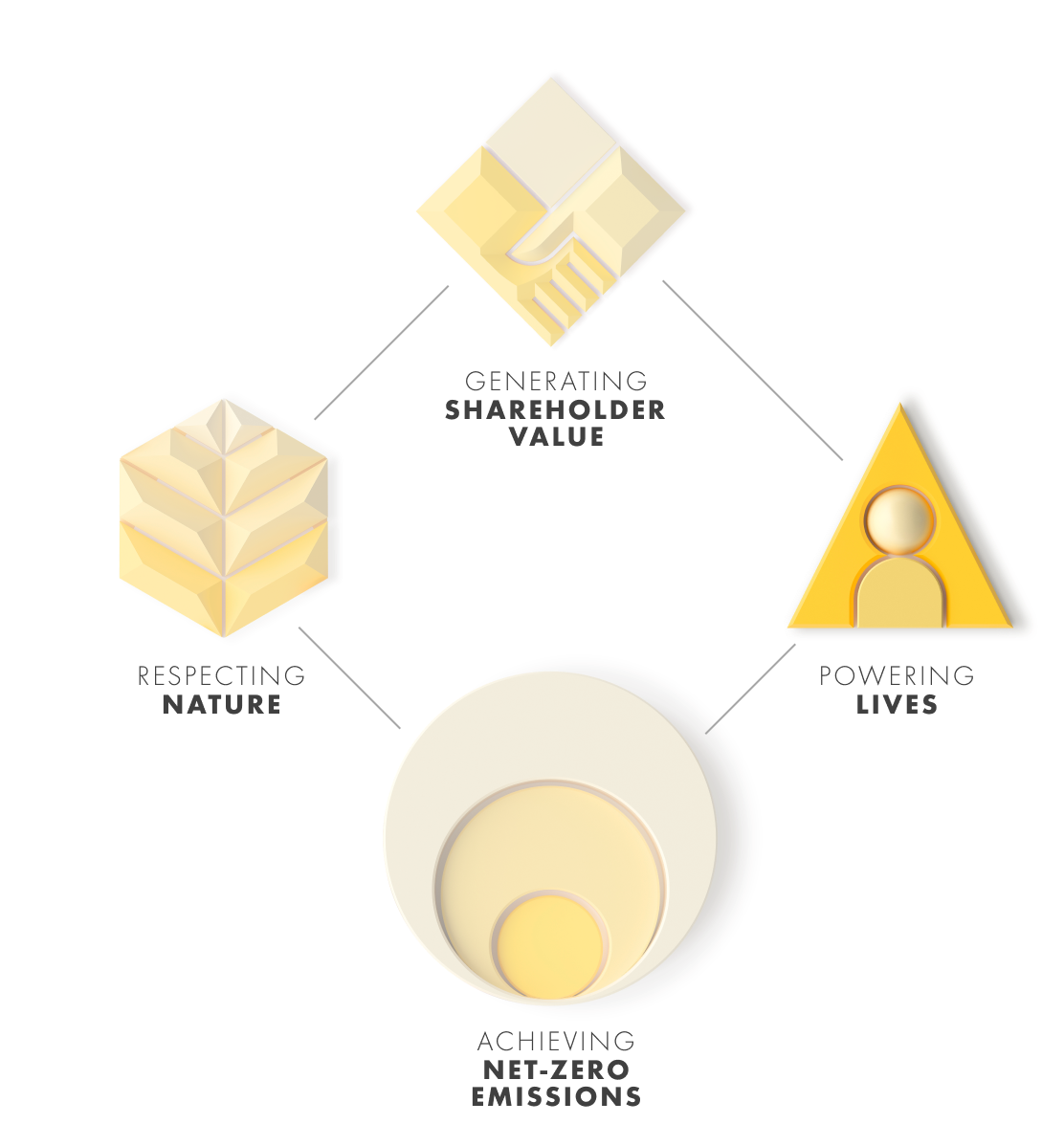

Underpinned by our core values

and our focus on safety

Our approach to taxes

When we invest in a country or location, we seek to build long-term relationships and develop our business sustainably. We recognise our responsibility towards investors, governments, employees and the local communities we are part of. The taxes we collect and pay represent one of the ways in which we embrace this responsibility. Our tax strategy is designed to support Shell in delivering our Powering Progress strategy. It is based on compliance, being transparent about our approach to tax and taxes paid and openness to dialogue with governments, businesses, investors and civil society.

The Board of Directors of Royal Dutch Shell plc approves our tax strategy, regularly reviews its effectiveness and maintains a sound system of risk management and internal control.

The Executive Vice President Taxation and Controller is responsible for tax matters and provides assurance based on our internal tax control framework. The Audit Committee assists the Board in maintaining a sound system of risk management and internal control and oversight over Shell’s financial reporting. A variety of standing matters and more specific topics are discussed by the Audit Committee throughout the year. As part of the year-end reporting process, the Audit Committee advises the Board on the adequacy of the system of risk management and internal control in place.

Responsible tax principles

In 2018, we endorsed the B Team Responsible Tax Principles, which were developed by a group of leading companies, including Shell. Civil society, investors and representatives from international institutions contributed to their development. In 2019, we adopted these principles as our own. The Shell Responsible Tax Principles guide our decisions on tax matters.

Shell Responsible Tax Principles

-

Principle 1. Accountability and Governance

Tax is a core part of corporate governance and responsibility and is overseen by Royal Dutch Shell plc’s Board of Directors.

-

Principle 2. Compliance

We are committed to complying with the tax legislation of the countries in which we operate and pay the right amount of tax at the right time, in the countries where we create value.

-

Principle 3. Business Structure

We will only use business structures that are driven by commercial considerations, are aligned with business activity and which have genuine substance. We do not seek abusive tax results.

-

Principle 4: Relationships with Authorities

We seek, wherever possible, to develop co-operative relationships with tax authorities, based on mutual respect, transparency and trust.

-

Principle 5: Seeking and Accepting Tax Incentives

Where we claim tax incentives offered by governments, we seek to ensure that they are transparent and consistent with statutory and regulatory frameworks.

-

Principle 6: Supporting Effective Tax Systems

We engage constructively in national and international dialogue with governments, business groups and civil society to support the development of effective tax systems, legislation and administration.

-

Principle 7: Transparency

We provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

Compliance

We are committed to compliance. We seek to comply with the letter and the spirit of the tax laws wherever we have a taxable presence and expect to pay tax on profits where the business activity took place. When available and appropriate, we use tax incentives and exemptions.

We seek to resolve any uncertainty in the interpretation of the tax laws directly with tax authorities, including through advance tax agreements. We may also seek a co-operative compliance approach, which involves regularly and proactively engaging with tax authorities and providing them with real-time information before filing the tax return.

These arrangements offer an opportunity for early resolution, minimising the risk of future disputes. Where necessary, we will seek a clear resolution through the judicial system to test the legal principle of the tax law concerned.

Our tax and finance staff supported the filing of around 43,000 tax returns in 2020. We aim to adhere to international best practices and aim for accuracy and timeliness when we fulfil our tax filing obligations.

Our tax control framework, policies and guidelines set out the standards, controls, risk management and assurance that establish boundaries for our tax activities. Our tax control framework also sets out practical guidance for our staff, including the procedures for considering tax risks. Our tax and data systems evolve continuously to deal with the growing demand for information from authorities. External auditors regularly review our tax controls as part of the audit of our financial results.

We do not condone, encourage or support tax evasion. Compliance is embedded in the Shell General Business Principles and the Code of Conduct. Employees, contract staff and third parties with which Shell has a business relationship may raise ethical and compliance concerns, anonymously if preferred, through the Shell Global Helpline.

We regularly monitor relevant changes and developments in tax systems. We review our corporate and financing structures to confirm that our presence in all countries, including low-tax jurisdictions, is grounded in substantive and commercial reasons.

Shell may seek the support of an external adviser where specialist technical expertise is required that is not available within Shell or where additional resources are required.

Transparency

We strive for an open dialogue on tax matters with governments, policymakers, businesses, investors, and civil society. Since 2003, we have taken important steps to be more transparent about the taxes we pay.

Timeline

-

2003

One of the initiators of the Extractive Industries Transparency Initiative (EITI)

We provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2012

First voluntary publication of tax payments in 14 countries

Publication of Shell’s Approach to TaxWe provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2016

First publication of Payments to Governments Report in line with European regulations (covering exploration and production activities)

We provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2017

Publication of Shell UK Tax Strategy and Statement on Tax Evasion

Shell’s first country-by-country report submitted to tax authoritiesWe provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2018

Pilot International Compliance and Assurance Programme

Shell commits to the B Team Responsible Tax PrinciplesWe provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2019

First publication of Shell’s Tax Contribution Report

We provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

-

2021

Shell agrees to report on environmental, social and governance performance factors, including tax, against the World Economic Forum Stakeholder Capitalism Metrics

We provide regular information to our stakeholders, including investors, policymakers, employees, professional service providers and the general public about our approach to tax and taxes paid.

Our participation in the development of the B Team Responsible Tax Principles reflects our ambition to align our tax strategy more closely with emerging best practice. Our Tax Contribution Report and future publications aim to demonstrate how we are applying our Responsible Tax Principles.

Open to dialogue

We welcome the opportunity to work with others in areas of shared interest. Our approach to tax considers the interests of relevant stakeholders. Through engagement with thought leaders, other companies, investors and civil society, we stay informed of developments that may impact our business.

We also regularly engage with policymakers to support the development of tax rules and regulations based on sound tax policy principles. In this way, we hope to contribute to the development of fair, effective and stable tax systems.

We also provide constructive input to industry groups and international organisations, such as the Extractive Industries Transparency Initiative (EITI), the B Team Responsible Tax Working Group (B Team) and Business at OECD, an international business network.

Internal voice

Alan McLean

Shell Executive Vice President Taxation and Controller

In September 2021, Alan McLean, Executive Vice President Taxation and Controller, addressed a European Parliamentary hearing on tax transparency: “We intend to continue to improve transparency and we hope others will do the same... At the same time, we believe it is important for transparency requirements to be aligned and consistent to ensure quality and comparability of data when informing the public debate, as well as ease of compliance for companies.”