Gibraltar

0 Employees

-

Third-party revenues

$1,758,417

-

Related-party revenues

$0

-

Total revenues

$1,758,417

-

Profit before tax

$234,456

-

Tax paid

$34,224

-

Tax accrued

$23,446

-

Tangible assets

$0

-

Stated capital

$0

-

Accumulated earnings

$0

Main Business Activities

- Integrated Gas

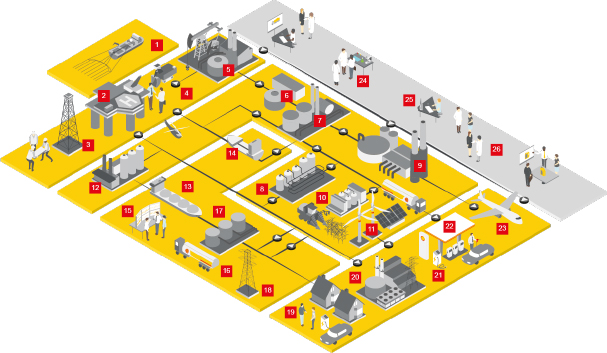

Shell LNG Gibraltar Limited is an incorporated joint venture between Shell (51%) and the government of Gibraltar. It was set up for the purpose of constructing and operating the first liquefied natural gas (LNG) regasification terminal in Gibraltar, replacing diesel with LNG for power generation. The construction and operation of the terminal were managed by Gasnor AS, a former Shell company registered in Norway that was divested in 2021.

As part of Shell’s ambition to develop the LNG bunkering business in the Strait of Gibraltar a new branch of a Dutch company, Shell LNG Bunkering B.V., was incorporated but the branch did not start operations in 2020.

Country Financial Analysis

The statutory corporate income tax rate in Gibraltar is 10%.

The figures in the table represent Gasnor’s branch activity in Gibraltar for the operation of the terminal.

Tax is paid in arrears. The tax accrued is the expected corporate income tax on profits arising in 2020 but is due and payable in 2021.