Philippines

4,829 Employees

-

Third-party revenues

$2,314,516,810

-

Related-party revenues

$434,202,041

-

Total revenues

$2,748,718,851

-

Profit before tax

$(233,736,274)

-

Tax paid

$111,243,144

-

Tax accrued

$71,166,351

-

Tangible assets

$1,161,226,921

-

Stated capital

$565,670,070

-

Accumulated earnings

$(367,189,862)

Main Business Activities

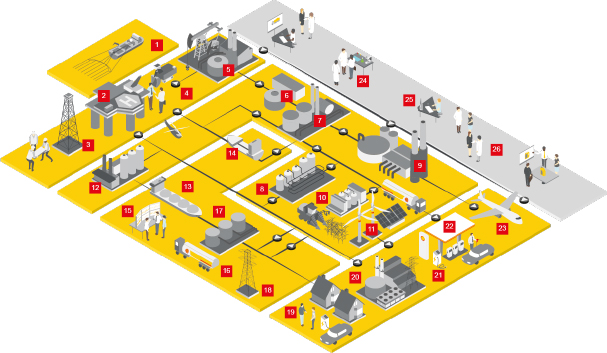

- Upstream and Integrated Gas

- Downstream

- Manufacturing

- Chemicals

- Trading and Supply

- Other support activities

Shell has been present in the Philippines for more than 100 years. Shell has an interest in and operates the upstream joint venture in the Malampaya gas field. Shell has more than 1,100 retail sites in the Philippines, and markets mainly gasoline and commercial fuels. It ceased its refinery operations in August 2020 to transform the facility into a full import terminal. Shell also has a Shell Business Operations Centre in the Philippines, which provides support services to other Shell companies.

Shell has a 55% interest in Pilipinas Shell Petroleum Corporation (PSPC), an integrated fuel refining and marketing company in the Philippines. PSPC was listed on the Philippine Stock Exchange in 2016.

Country Financial Analysis

The statutory corporate income tax rate in the Philippines is 30% but was reduced to 25% from July 1, 2020.

The total tax paid in 2020 related mainly to profits in the upstream business. Downstream profits were negatively impacted by the discontinuation of refinery activities, inventory holding losses, and lower marketing volumes as a result of COVID-19.

The Philippines granted some of our downstream operations an Income Tax Holiday but this ceased on August 6, 2020 when we took the decision to convert our refinery into an import terminal.

Our Payments to Governments Report for 2020 also shows that Shell paid around $457 million in production entitlements.