Australia

2,595 Employees

-

Third-party revenues

$2,703,081,216

-

Related-party revenues

$6,482,788,036

-

Total revenues

$9,185,869,252

-

Profit before tax

$(11,432,704,550)

-

Tax paid

$29,163,263

-

Tax accrued

$10,643,085

-

Tangible assets

$31,169,617,198

-

Stated capital

$53,590,206,563

-

Accumulated earnings

$(6,492,017,103)

Main Business Activities

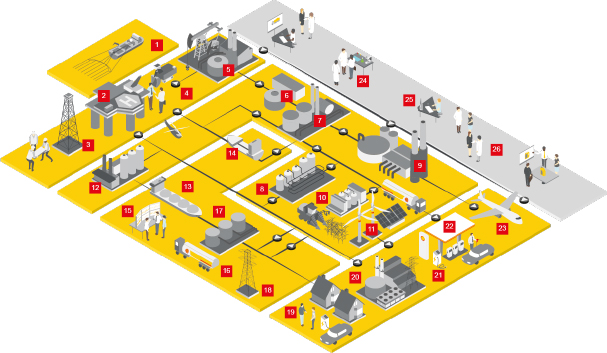

- Upstream and Integrated Gas

- New Energies [A]

Shell began operations in Australia in 1901. Today, we are a leading gas producer and are playing our part in the transition to a low-carbon future by investing in the power sector, renewable energy sources and decarbonisation activities.

Shell in Australia has invested heavily in onshore and offshore natural gas and liquefied natural gas (LNG) exploration and development projects, power and gas trading, renewable energy and greenhouse gas emissions abatement projects. Shell in Australia is comprised of two income tax groups: Shell Energy Holdings Australia Limited and QGC Upstream Holdings Pty Ltd.

Country Financial Analysis

The statutory corporate income tax rate in Australia is 30%. Shell’s 2020 revenue is derived from sales of LNG, condensate, liquefied petroleum gas, domestic gas and power. In 2020, Shell in Australia reported a loss of $11 billion mainly because of asset impairments following a drop in demand and prices related to COVID-19. Shell did not receive tax relief for these impairments. The tax paid of $29 million includes payments for previous years.

Our Payments to Governments Report for 2020 also shows around $84 million of payments in royalties, fees and infrastructure improvements.

[A] New Energies was rebranded to Renewables and Energy Solutions in 2021.