Ukraine

5 Employees

-

Third-party revenues

$16,674

-

Related-party revenues

$0

-

Total revenues

$16,674

-

Profit before tax

$112,465

-

Tax paid

$7,279

-

Tax accrued

$0

-

Tangible assets

$7,925

-

Stated capital

$25,691,419

-

Accumulated earnings

$(704,285,080)

Main Business Activities

- Downstream

- Upstream and Integrated Gas

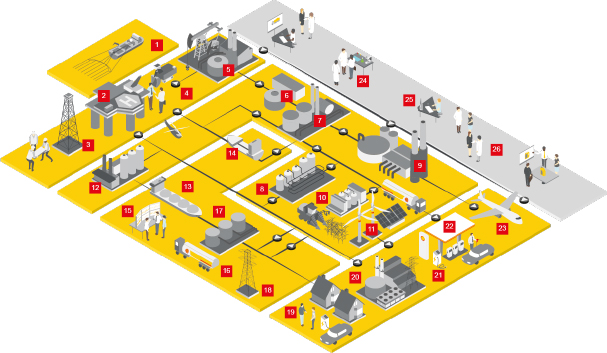

Shell has been present in Ukraine since 2006 and has predominantly downstream activities through majority interests in joint venture companies. Shell operates 132 retail sites in Ukraine. The downstream retail joint venture pays taxes locally and has around 1,500 employees. Shell ceased its exploration activities in Ukraine in 2015.

Country Financial Analysis

The statutory corporate income tax rate in Ukraine is 18%. The profit and the tax on the downstream activities of the joint venture companies are not included in our country-by-country (CbCR) report because the accounting principles of the joint ventures are based on equity accounting. In line with CbCR reporting requirements, these numbers are reported in the shareholder locations.

Shell paid low amounts of corporate income tax in Ukraine as a result of losses from the unwinding of the upstream activities. In addition, the joint ventures pay taxes locally that are not included in this report.