Trinidad and Tobago

487 Employees

-

Third-party revenues

$142,018,066

-

Related-party revenues

$226,838,207

-

Total revenues

$368,856,273

-

Profit before tax

$(560,547,258)

-

Tax paid

$14,516,267

-

Tax accrued

$(28,596)

-

Tangible assets

$1,057,282,782

-

Stated capital

$442,285,755

-

Accumulated earnings

$(596,347,354)

Main Business Activities

- Integrated Gas

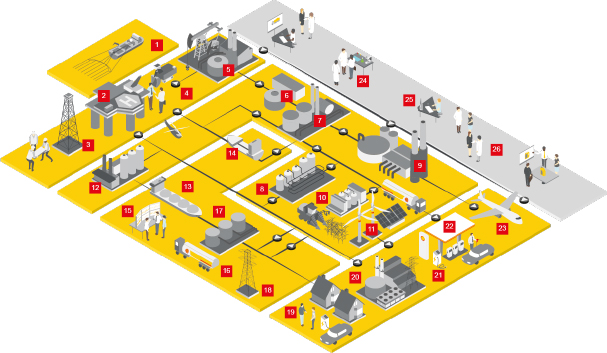

Shell has been active in Trinidad and Tobago since 1913. Following Shell’s 2013 acquisition of Repsol’s liquefied natural gas (LNG) business and the 2016 acquisition of BG Group, Shell has a larger presence in Trinidad and Tobago.

Shell’s portfolio in Trinidad and Tobago includes exploration and production activities through both operated and non-operated ventures, as well as gas and oil pipelines and LNG facilities.

Country Financial Analysis

The general statutory corporate income tax rate in Trinidad and Tobago is 30%. There is a separate tax regime for petroleum operations with a corporate income tax rate of 55%.

In Trinidad and Tobago, tax filings for production-sharing contracts (PSCs) are assessed according to the individual legal entity and asset block. This means that, in general, losses in one PSC may not be offset against profits arising elsewhere.

Overall, Trinidad and Tobago reported a loss for accounting purposes for the majority of assets in production. As a result, $15 million of corporate income tax was paid on the profits of a few income-generating assets. Despite a reduction in total revenues for the year, the overall loss for the year is less compared with the prior year mainly as a result of the remeasurement of certain accounting provisions.

Our Payments to Governments Report for 2020 also shows that Shell paid around $75 million in production entitlements, royalties and fees.