South Africa

529 Employees

-

Third-party revenues

$3,645,451,355

-

Related-party revenues

$244,169,296

-

Total revenues

$3,889,620,651

-

Profit before tax

$(452,005,555)

-

Tax paid

$62,315

-

Tax accrued

$774,932

-

Tangible assets

$877,475,430

-

Stated capital

$209,223,819

-

Accumulated earnings

$554,432,404

Main Business Activities

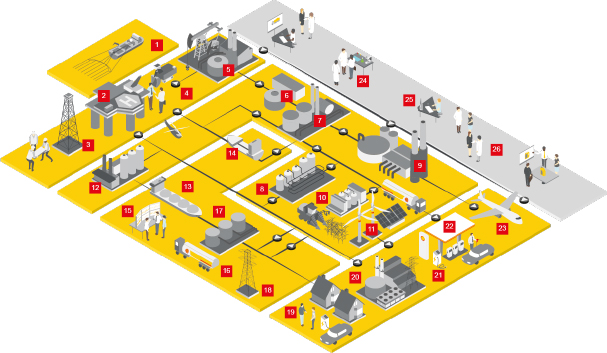

- Upstream

- Downstream

- Manufacturing

Shell has been present in South Africa since 1902.

Shell has a wide network of retail sites and is active in commercial fuels, lubricants, aviation fuels, marine and upstream exploration. Shell also jointly owns the Shell & BP South African Petroleum Refineries (Pty) Limited refinery, in Durban with BP. The refinery manufactures a variety of petroleum products including gasoline, diesel, paraffin, aviation fuel, liquid petroleum gas, base oil, solvents and marine fuel oil.

Country Financial Analysis

The statutory corporate income tax rate in South Africa is 28%.

In South Africa, corporate income taxes are paid in advance, based on estimated taxable income.

Shell reported a loss before tax for a number of reasons, including a significant drop in demand and prices as a result of COVID-19 and impairments in the value of assets. Tax paid relates to a settlement for prior years agreed with the tax authorities in 2020.