Kazakhstan

393 Employees

-

Third-party revenues

$33,151,226

-

Related-party revenues

$1,500,836,160

-

Total revenues

$1,533,987,386

-

Profit before tax

$93,195,835

-

Tax paid

$82,877,493

-

Tax accrued

$117,628,766

-

Tangible assets

$10,746,054,041

-

Stated capital

$0

-

Accumulated earnings

$0

Main Business Activities

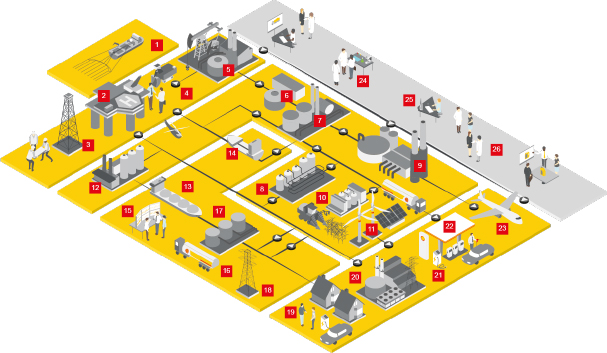

- Upstream and Integrated Gas

- Other support activities

Shell has been present in Kazakhstan since 1993. We have interests in the Karachaganak and Kashagan projects (Shell interest 29.25% and 16.81%, respectively), which generate revenues from oil and gas sales. We also have a minority interest in the Caspian Pipeline Consortium, which transports oil to the coast of the Black Sea.

Country Financial Analysis

The statutory corporate income tax rate in Kazakhstan is 20%. There are different tax rates for certain production-sharing agreements and subsoil use contracts. The tax rate is 30% for Kashagan and 33.5% for Karachaganak. The Kashagan project began production in November 2016 and started to generate revenues but reported taxable losses during 2016-2020. Revenues fell in 2020 because of a significant drop in demand and prices as a result of the COVID-19 pandemic.

The tax paid figure relates primarily to profit generated from the Karachaganak project which is also disclosed in our Payments to Governments Report for 2020.

Our Payments to Governments Report for 2020 also shows that Shell paid around $424 million in other payments.