Strategy: “Let’s make the future”

Strategy

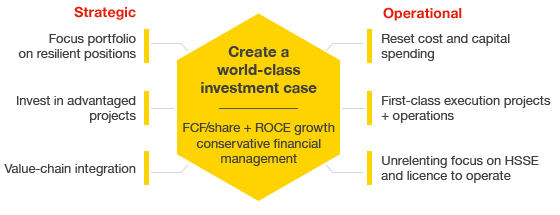

We are re-shaping Shell to create a world-class investment case for shareholders. This strategy is underpinned by Shell’s outlook for the energy sector and substantial changes in the world around us. The dynamics of rising global population and standards of living should continue to drive demand growth for oil and gas for decades to come. At the same time, there is a transition underway to a lower-carbon energy system; a world with increased customer choice; higher energy price volatility; and, with the advent of low-cost shale reserves, a new dynamic in value creation in oil and gas.

Against this backdrop, Shell has four distinct strategic ambitions:

- Creating a world-class investment case, by reshaping Shell to grow free cash flow per share (FCF/share) and increase returns, all underpinned by a conservative financial framework;

- To be more relevant in our industry, and to grow our value share – being a respected voice in the energy industry and growing our market capitalisation;

- Reducing our carbon intensity as part of the energy transition; and

- Shared value – making sure that Shell is a force for good in society.

We have defined our strategy to deliver against these long-term ambitions and believe that success will lead to sustaining a world-class investment case.

Portfolio and priorities

We segment our portfolio into a number of strategic themes. We have strategies for each of them, with tailored technology approaches, distinctive markets and financial targets. We allocate capital to each of these strategic themes to drive an optimal cash flow and returns profile in the company, over multiple timelines. When we set our plans and goals, we do so on the basis of delivering sustained returns over decades, not just years.

Asset sales and disciplined capital investment are key elements of this strategy. Following the acquisition of BG, we expect the pace of our asset sales to increase, with $30 billion of divestments planned for 2016-18. Up to 10% of Shell’s oil and gas production is earmarked for sale, including five to ten whole country positions and selected midstream and downstream assets. This is a value driven – not a time driven – divestment programme, and an integral element of Shell’s portfolio improvement plan.

We are planning to spend between $25 billion and $30 billion each year until 2020. We see $30 billion as a ceiling, as we reduce debt following the BG deal and meet our goals for shareholder distributions. The $25 billion level reflects the expenditure we believe we need to maintain medium-term growth in the company; we can go below that level if oil prices warrant that. The final outcome in any given year will be determined by the pace of development and overall affordability considerations. For 2016, we expect to spend $29 billion or less.

Create a world-class investment case

Shell ambition:

- World-class investment case

- Relevant in our industry + growing market capitalisation

- Reducing our carbon intensity

- Shared value

Investment priorities

Cash engines: Today

- Funds dividends + balance sheet

- Competitive + resilient

- Strong, stable returns and free cashflow

Conventional Oil & Gas, Integrated Gas, Oil Sands Mining, Oil Products

Growth priorities: 2016+

- Cash engines 2020+

- Affordable growth in advantaged positions

- ROACE + free cashflow pathway

Deep Water, Chemicals

Future opportunities: 2020+

- Material value + upside

- Path to profitability

- Managed exposure

Shales, New Energies