Deep water

Deep water is a growth priority for Shell. We have advantaged positions in Brazil, the Gulf of Mexico, Nigeria and other regions that offer substantial and profitable growth potential. We expect our global deep-water production from already discovered fields to double to more than 900 thousand barrels of oil equivalent (boe) per day by the early 2020s. Exploration in these established basins adds further growth potential.

The Stones floating production, storage and offloading vessel, during construction work in Singapore. Stones is our first FPSO in the Gulf of Mexico.

We pioneered deep-water development in the US Gulf of Mexico and have led the industry on technological achievements for decades. Our Stones development, due on stream in 2016, is the deepest producing facility in the world. The Appomattox project, has 650 million barrels of resources and was given the go-ahead after reducing the total cost estimate by 20% relative to its initial project estimate. We expect to begin production later this decade and will open up a new geological play in the Jurassic Norphlet formation. Other producing assets in the USA include Auger, Brutus, Enchilada, Mars, Mars B, Perdido and Ursa.

Of Shell’s global deep-water production today, approximately 40% comes from our operated and non-operated assets offshore Brazil. Our operated Parque das Conchas project, in the Campos Basin off the coast of Brazil, began production from its third phase in 2016. In the Santos Basin, we have a 20% interest to explore and develop the giant Libra pre-salt oil field. We also have working interests in other large pre-salt discoveries in the same basin, which were gained through our acquisition of BG.

In Nigeria, production from the Bonga field was expanded in 2015 with the start-up of phase 3 of the development. In offshore Malaysia, Shell operates five producing oil fields, including the Gumusut-Kakap deep-water field where production began in 2014. We also operate and are developing the Malikai deep-water field off the coast of Malaysia.

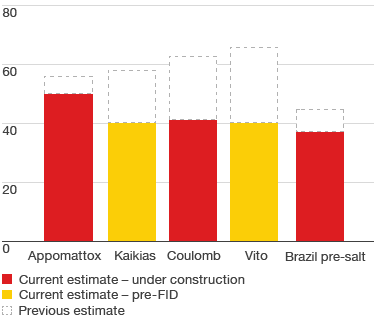

Lowering capital intensity

$ per boe break-even cost (examples)