LNG

The acquisition of BG has accelerated our growth strategy in LNG and underpins our role as the largest independent producer and marketer of LNG. At the end of 2015, Shell and BG had 37.5 mtpa of liquefaction capacity. We also have 12 mtpa under construction, including capacity rights from third-party plants. Going forward, our primary focus will be on growing free cash flow and providing competitive returns, complemented by a drive to create and meet new gas demand, while spending our capital wisely, and moderating the pace of new final investment decisions.

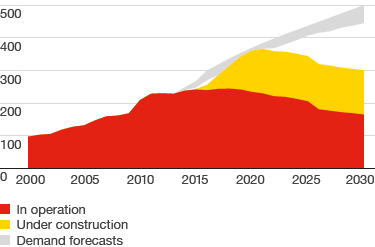

The global LNG market is growing and diversifying, with more countries importing LNG, more buyers emerging in existing LNG import countries and LNG playing a growing role in new market segments such as transport. Since 2000, LNG demand has risen by around 6% per annum and the market reached 250 mtpa in 2015. There are now over 30 importing and around 20 exporting countries, and this is expected to grow to as many as 50 and 25, respectively, by early next decade.

We expect global LNG demand to double by 2030, assuming there is additional investment in supply. There is currently over 100 mtpa of LNG capacity under construction or recently commenced production, primarily in Australia and North America. The market is expected to remain well-supplied for the next few years. Despite most of this volume having been contracted to either end-customers or portfolio players, this is leading to a softening of the market. The fundamentals of this market are changing but remain robust.

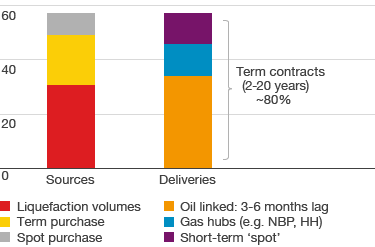

The vast majority of our LNG portfolio is sold on long-term contracts, ranging from 2 to 20 years, linked to oil and gas-hub prices. Some volumes are sold on a short-term basis and these sales mostly offset spot purchases.

LNG producers still need offtake agreements with creditworthy buyers to finance new LNG projects. LNG buyers are looking for competitive and reliable supply constructs that provide flexibility and different pricing constructs. Shell is well placed to meet the needs of suppliers and buyers in this industry.

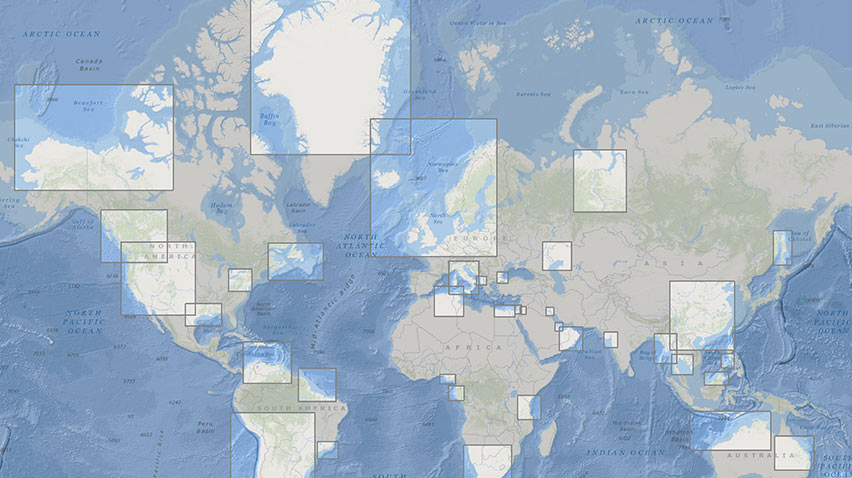

We are actively developing new markets and outlets for our gas. We have capacity rights for around 40 mtpa in 10 regasification terminals around the world and are actively pursuing additional opportunities. As well as pursuing further long-term sales, we are going further down the value chain, such as behind the import terminals, to create and secure new premium demand, leveraging our marketing and power trading capabilities. We are also part of the creation of a new market segment for LNG in the transport sector. LNG for shipping and heavy road transport is a very promising and potentially material new segment that Shell is well positioned to serve.

Global LNG supply + demand outlook

mtpa

LNG sales + pricing linkage

mtpa (2015 basis, Shell + BG)

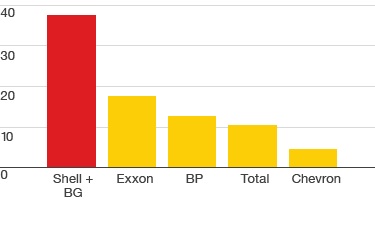

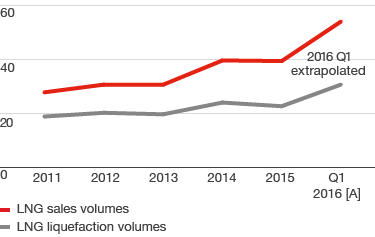

Shell LNG volumes

mtpa

[A] The acquisition of BG was completed on February 15, 2016.

Liquefaction capacity

Capacity at 2015 year-end in mtpa